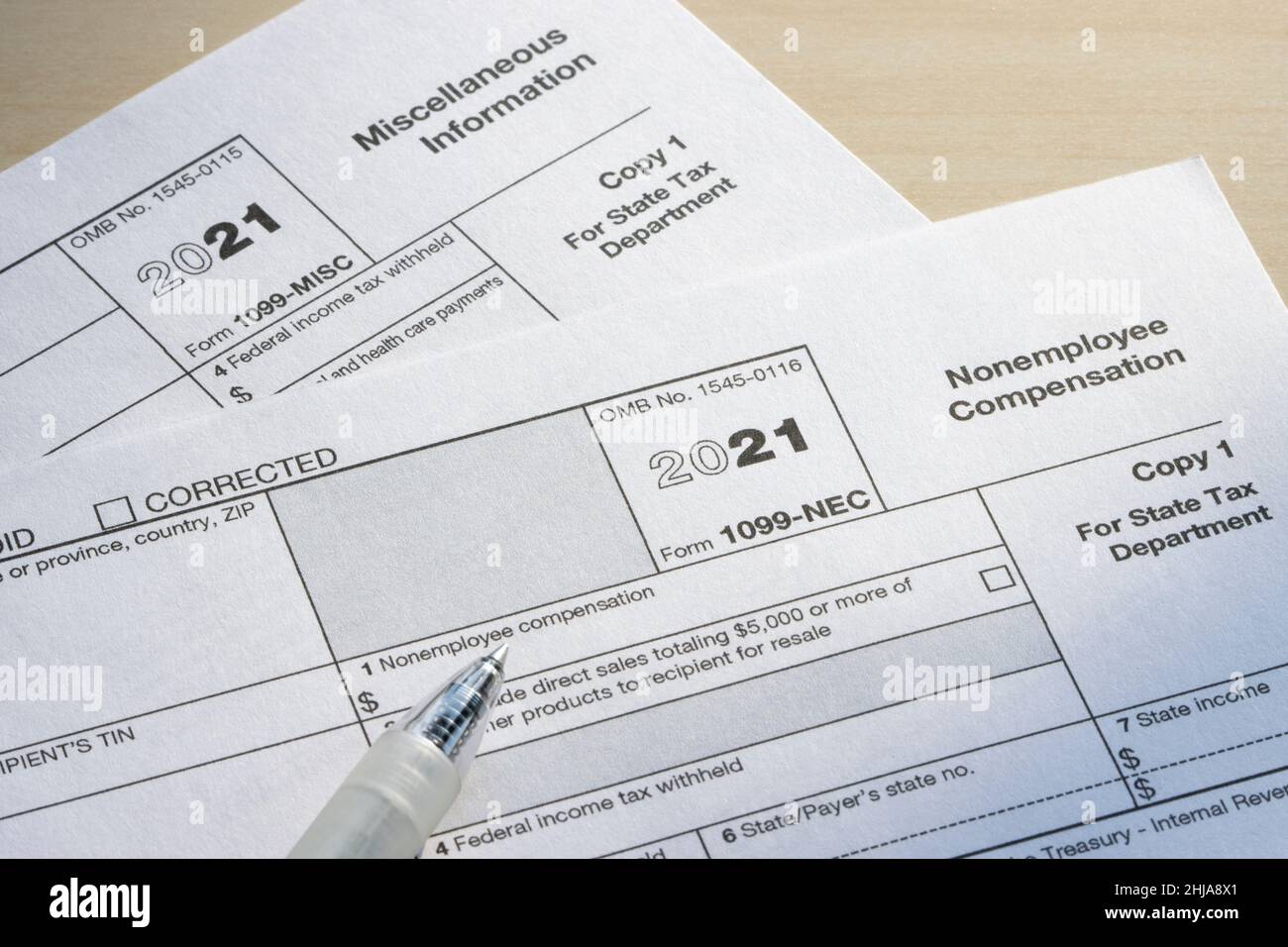

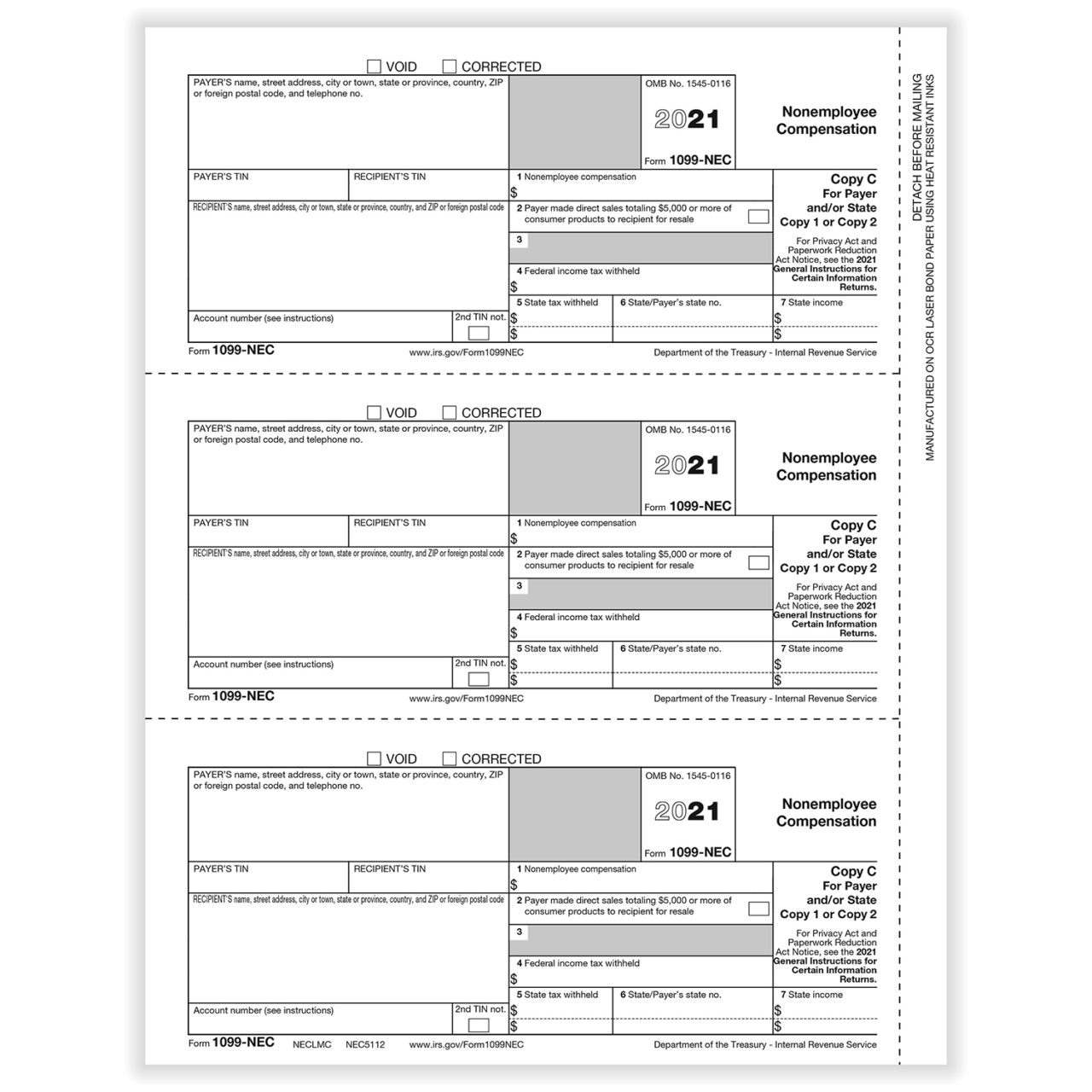

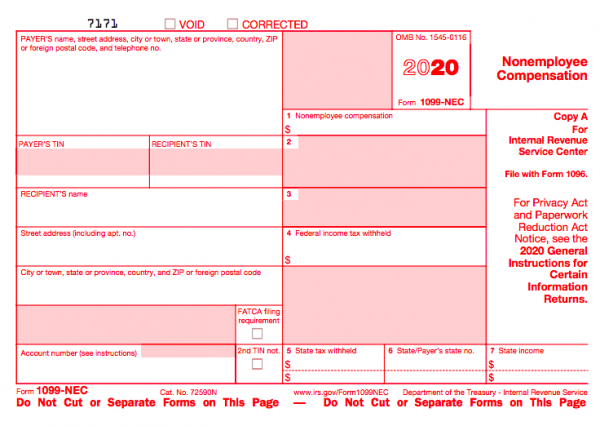

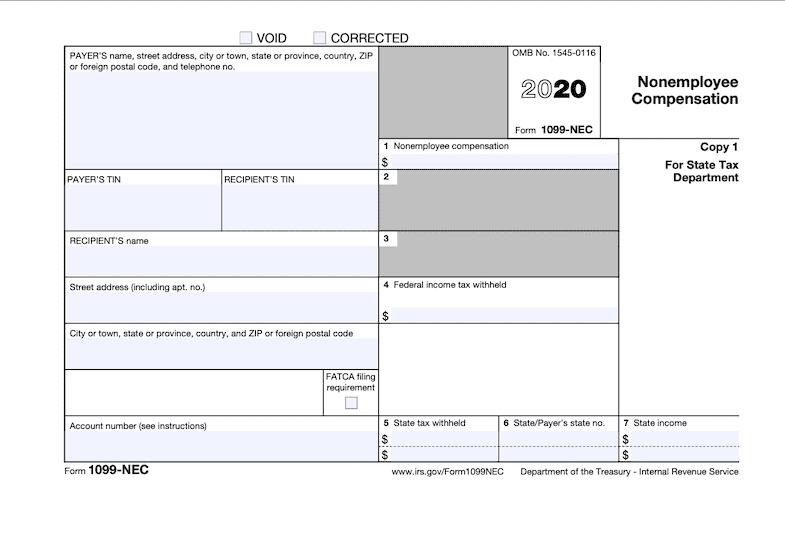

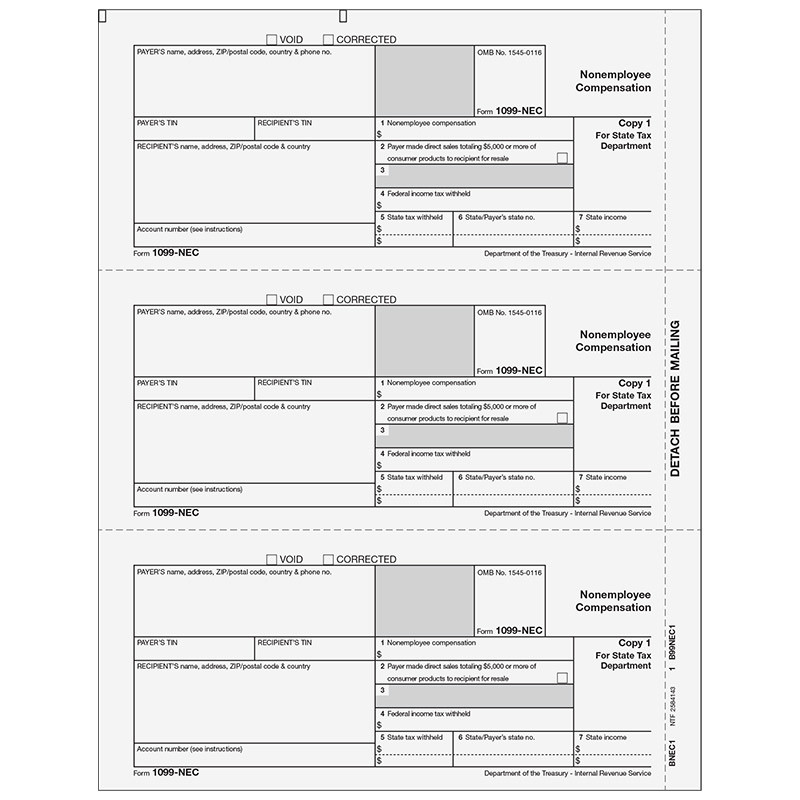

Form 1099 Nec Nonemployee Compensation State Copy 1

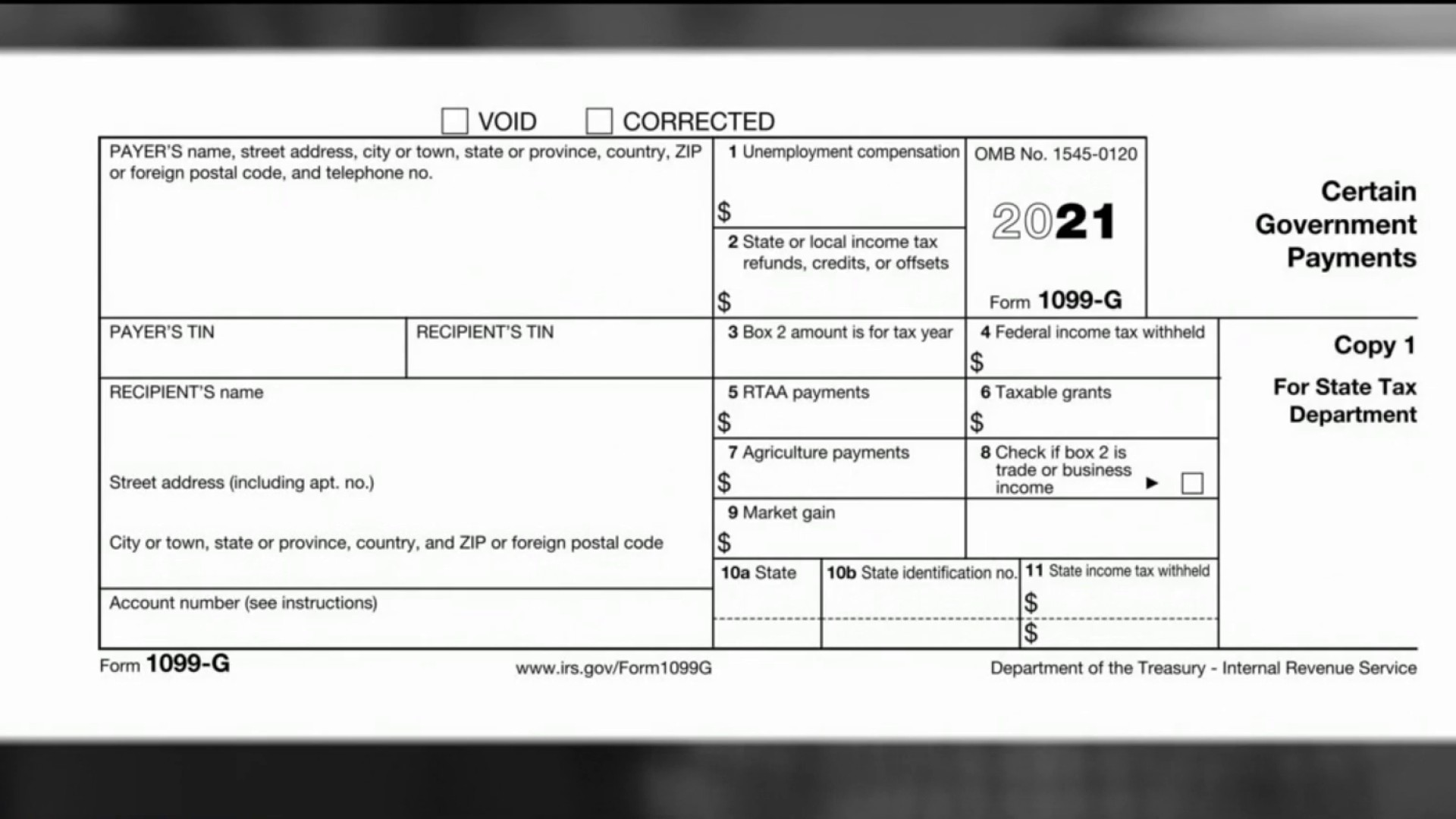

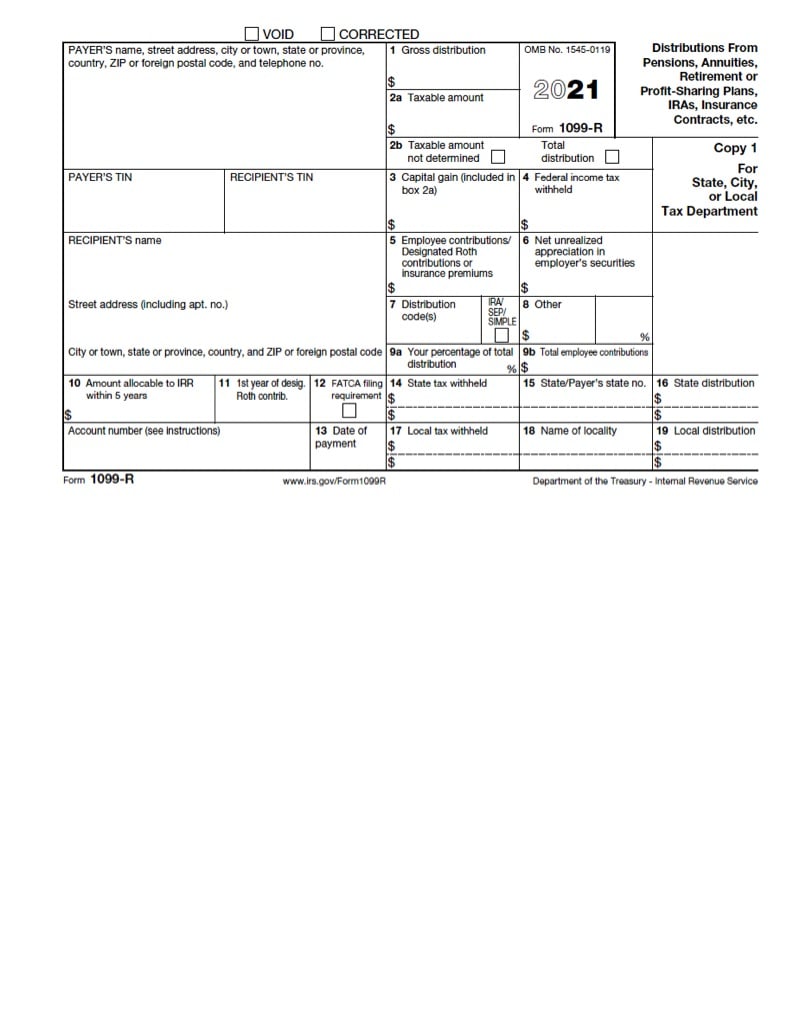

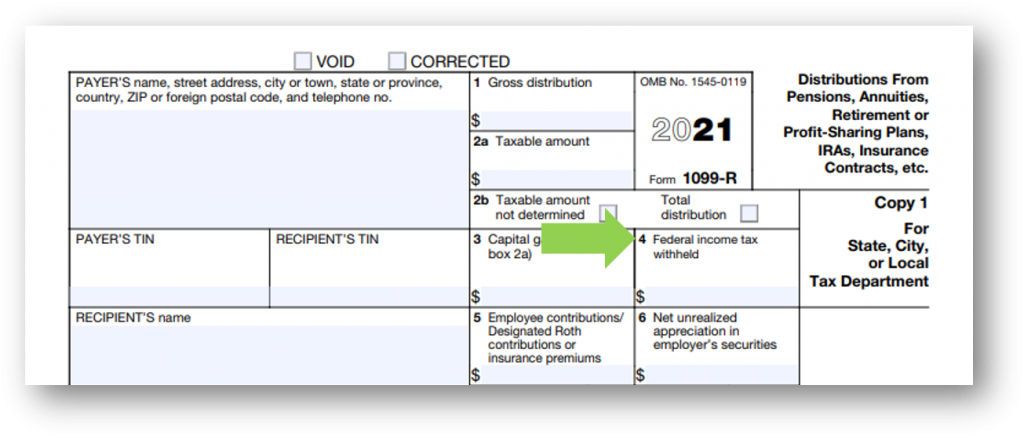

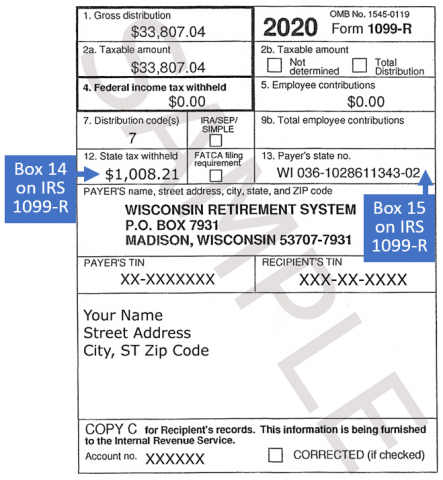

It is filing season and your clients may be asking you where to send the "state copy" of an information return, such as a W2 for an employee and a 1099 to other payees If your client filed paper returns with IRS, they do not need to send a paper copy to us IRS will forward the information to us, whether they are located in or out ofInformation returns (1099) New for 21 tax year 1099K, third party network transactions An information return is a tax document that banks, financial institutions, and other payers send to the IRS to report payments paid to a nonemployee during a

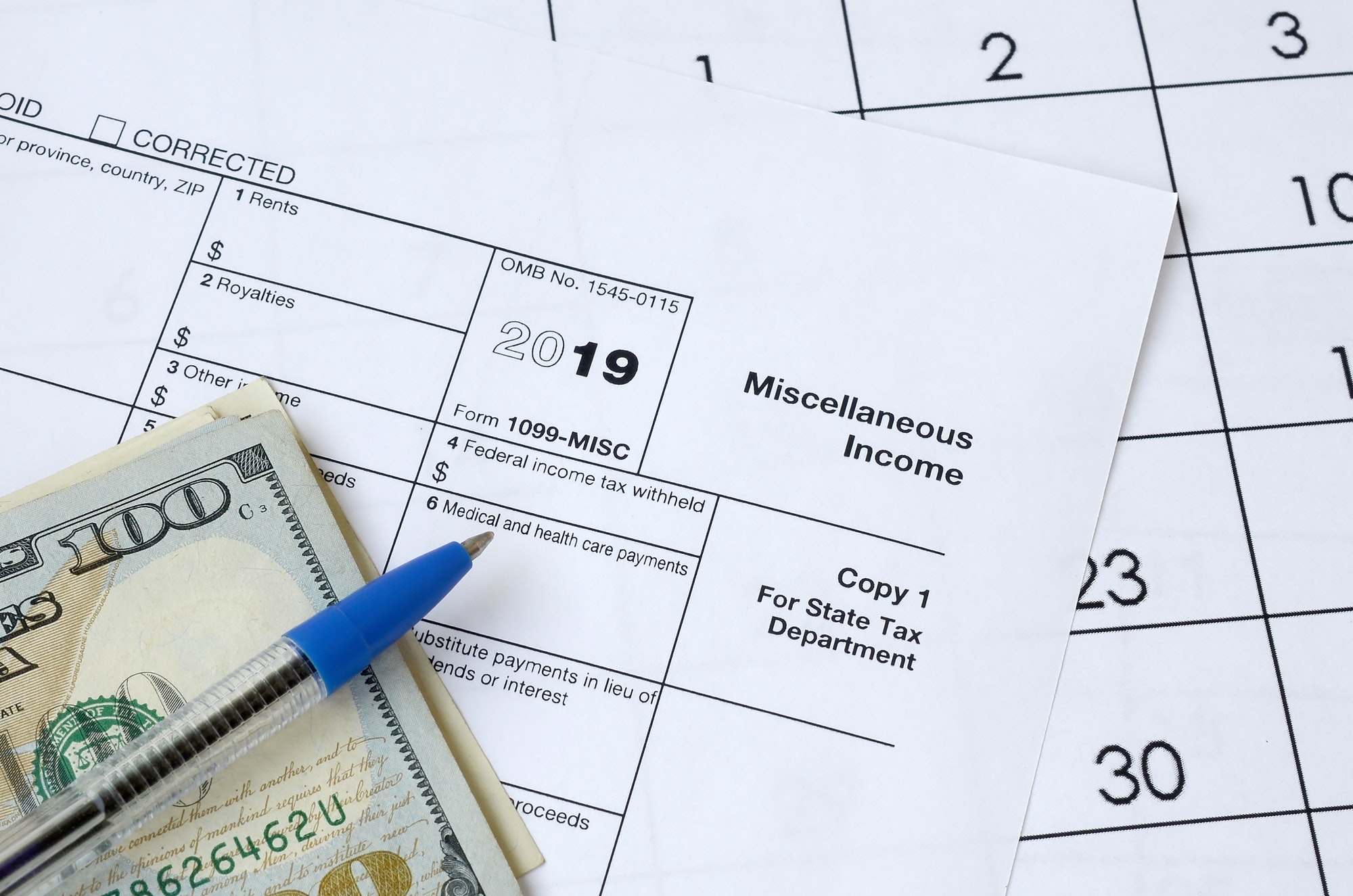

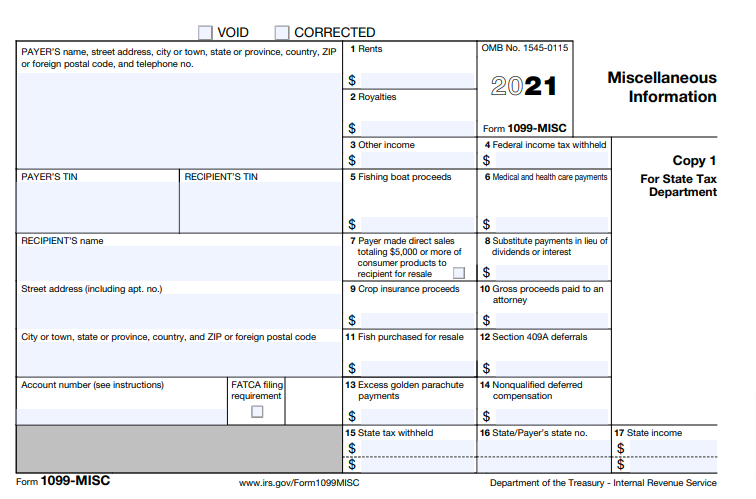

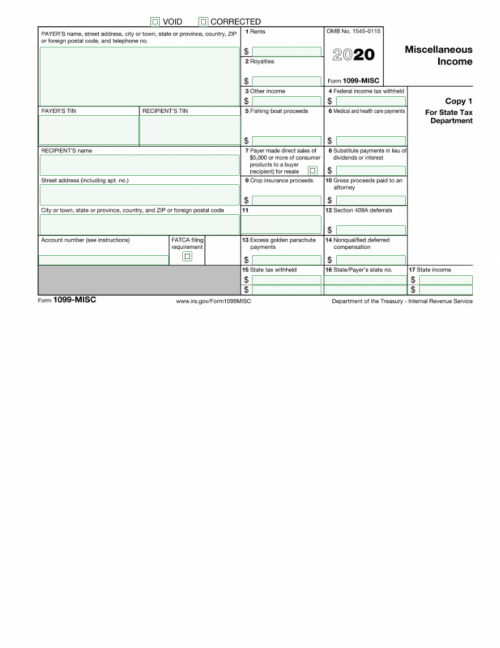

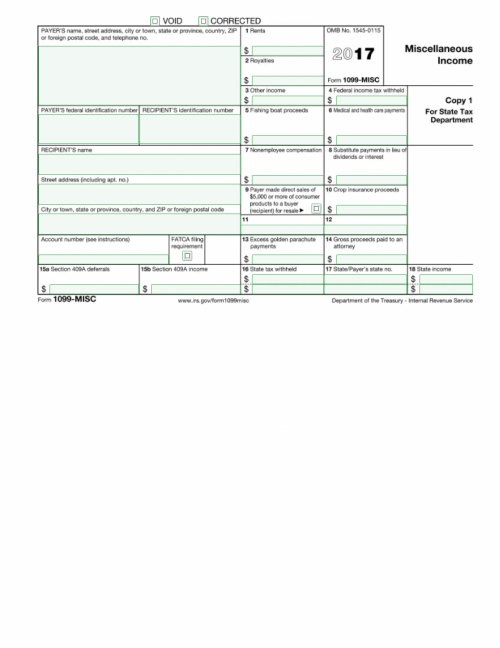

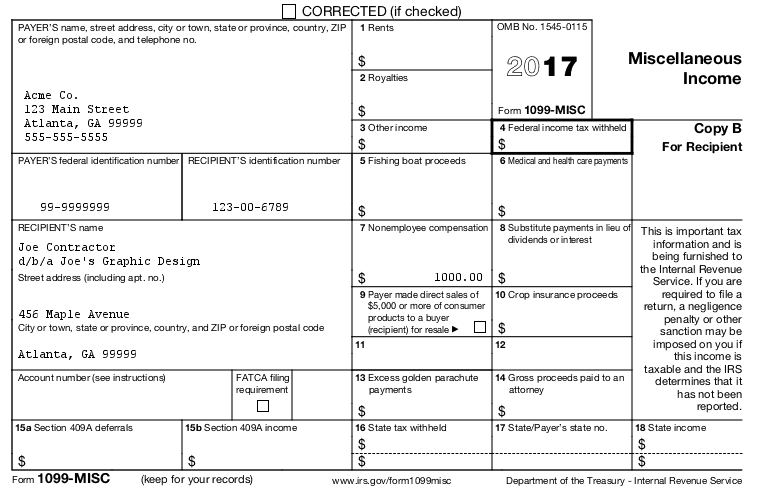

1099 misc copy 1 state tax department

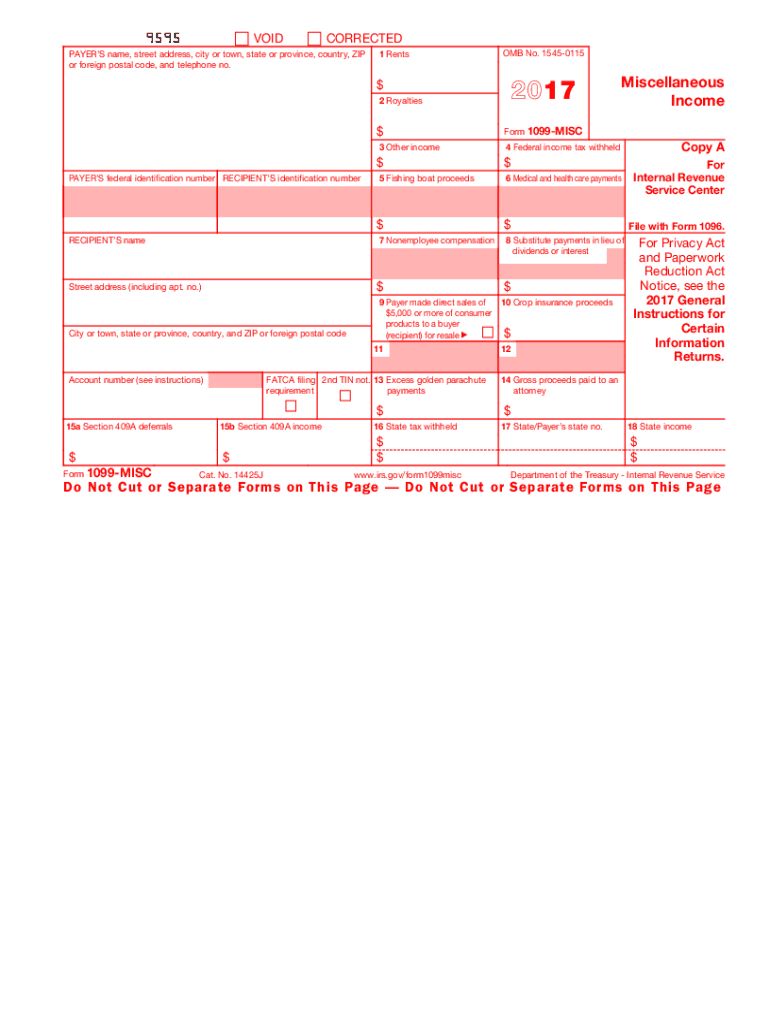

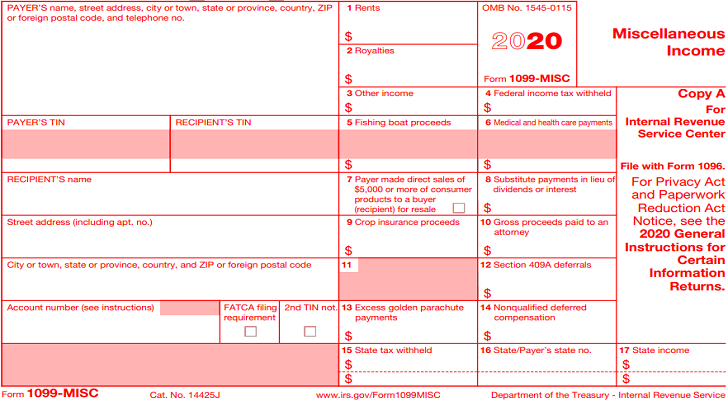

1099 misc copy 1 state tax department-The filing deadline for W2s and 1099s is February 15 W2s and 1099s must be filed using GovConnectIowa Businesses that issued W2s or 1099s that contain Iowa withholding must electronically file those documents with the Iowa Department of Revenue using GovConnectIowaThis data is an essential tool the Department uses to increase the accuracy ofForm 1099MISC Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no PAYER'S TIN RECIPIENT'S TIN RECIPIENT'S name

1

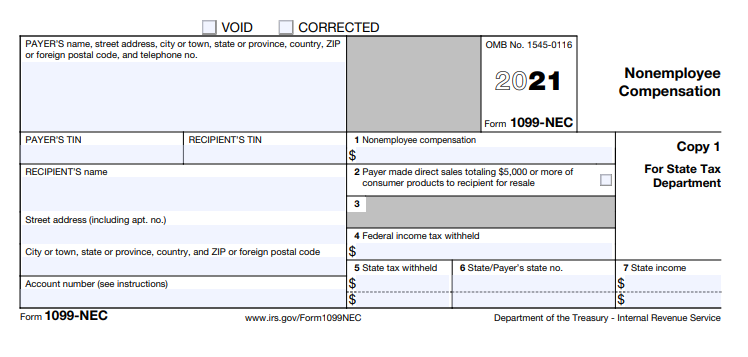

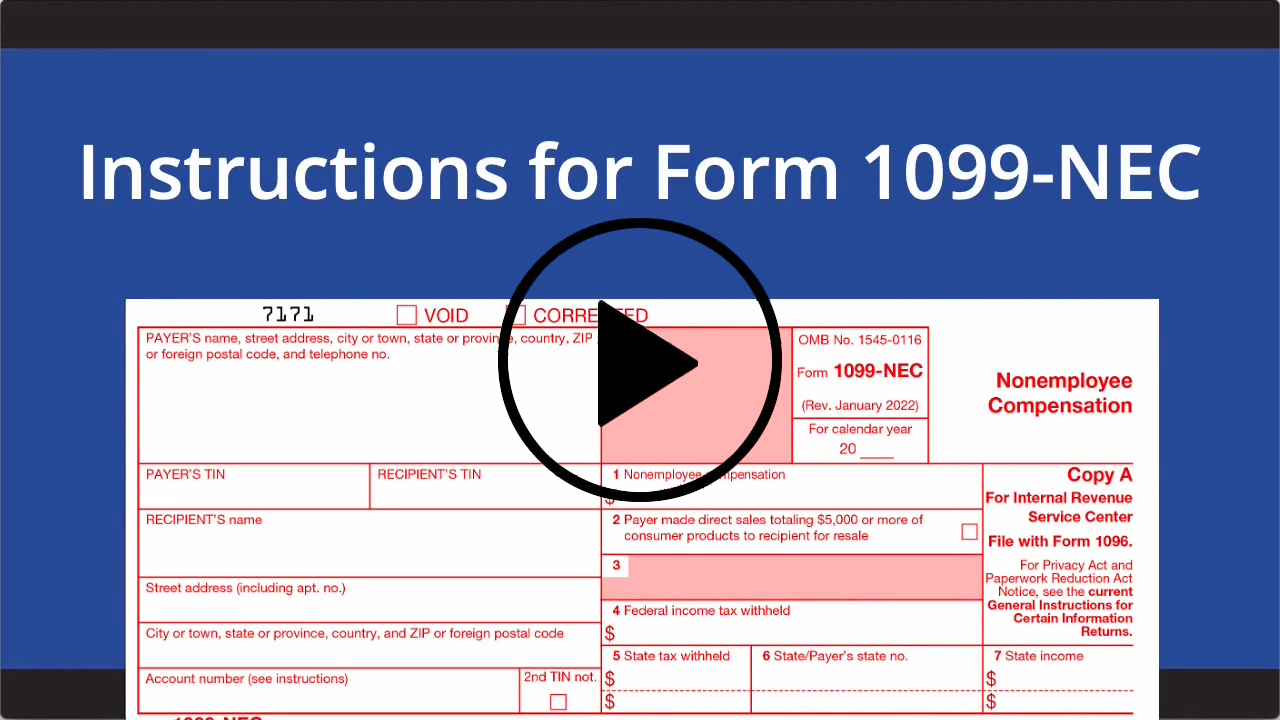

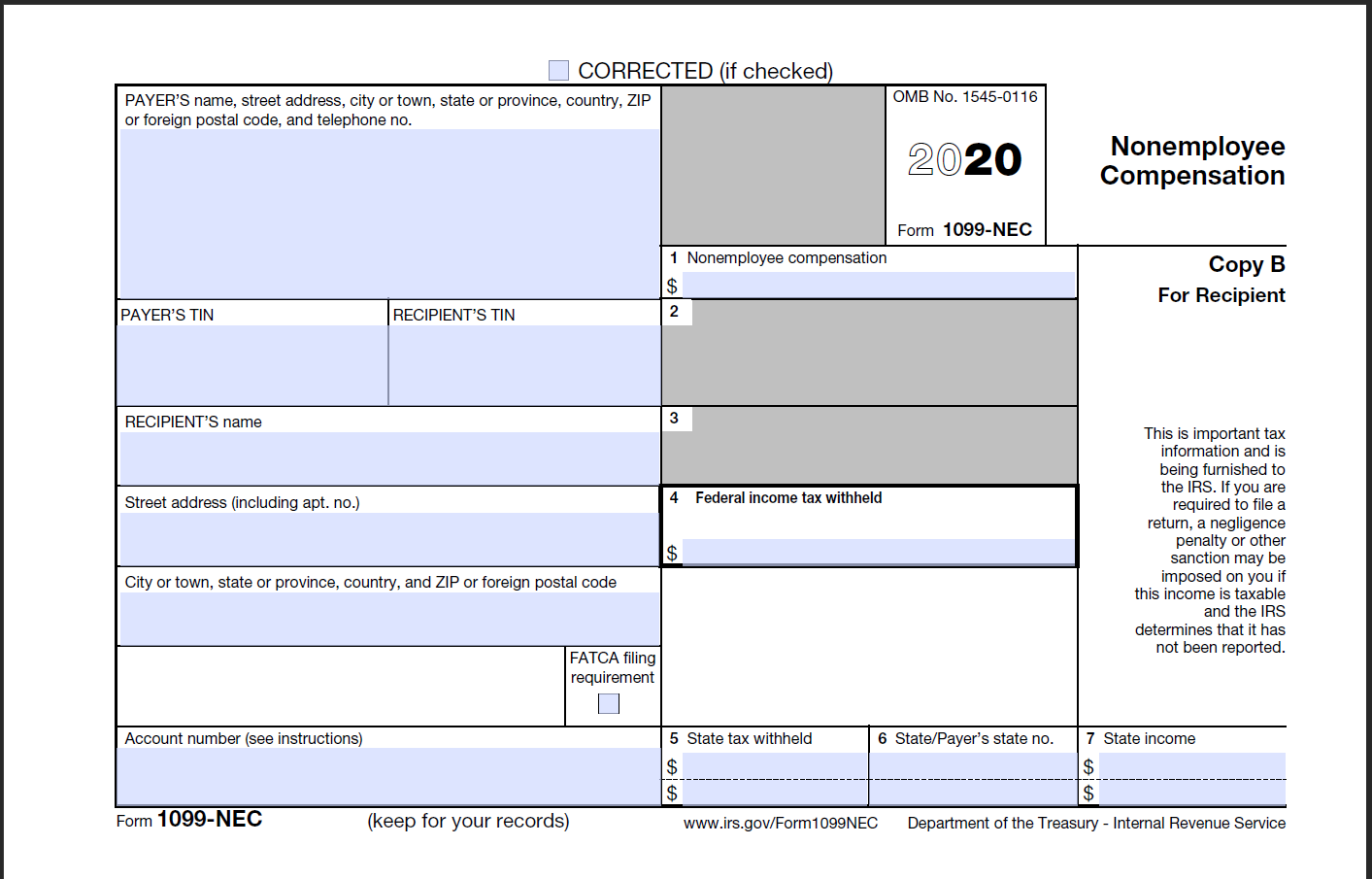

State/Payer's state no 7 State income $ Form 1099NEC Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP1099B 22 Cat No V Proceeds From Broker and Barter Exchange Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIPIf you wish to receive a copy of the confirmation PDF, enter your email address belowThis is optional and is provided as a backup if you cannot open/save the PDF on the next page Entering your email address permits the Virginia Department of Taxation to email you the confirmation PDF for this transaction, which contains return and payment details

Boxes 5, 6, and 7 The IRS doesn't require that you fill in these boxes, but your state's department of taxation might require a copy of the Form 1099NEC with this information Enter the person's state income, any state taxes you might have withheld, and identify the state or states to which you'll be reportingDoes Copy 1 for State Tax Department go to the recipient with Copy B of the 1099 MISC form?No See Publication NYS50, Employer's Guide to Unemployment Insurance, Wage Reporting and Withholding Tax , section 3, part Y, Statements for employees and annuitants ( page 35)

1099 misc copy 1 state tax departmentのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

|  | |

|  |  |

|  |  |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  | |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  | |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

| ||

|  |  |

|  | |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  |  |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png) |  | |

|  |  |

|  |  |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  | |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  | |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | /1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg) |

|  |  |

「1099 misc copy 1 state tax department」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|

For tax year 21, New Mexico only required business owners to file Form 1099MISC with the New Mexico Taxation and Revenue Department if the payment(s) derive from oil and gas production located within the stateConnecticut You must efile forms if submitting 25 or more Forms W2 or 1099MISC You will need to file Form CTW3 with Forms W2 Mail W2 forms to Department of Revenue Services State of Connecticut PO Box 2930 Hartford, CT You will need to file Form CT1096 with Forms 1099MISC Mail 1099MISC forms to

Incoming Term: 1099 copy 1 for state tax department, 1099-nec copy 1 for state tax department, form 1099 copy 1 for state tax department, 1099 misc copy 1 state tax department, who gets copy 1 for state tax department 1099, where do i send 1099-misc copy 1 for state tax department,