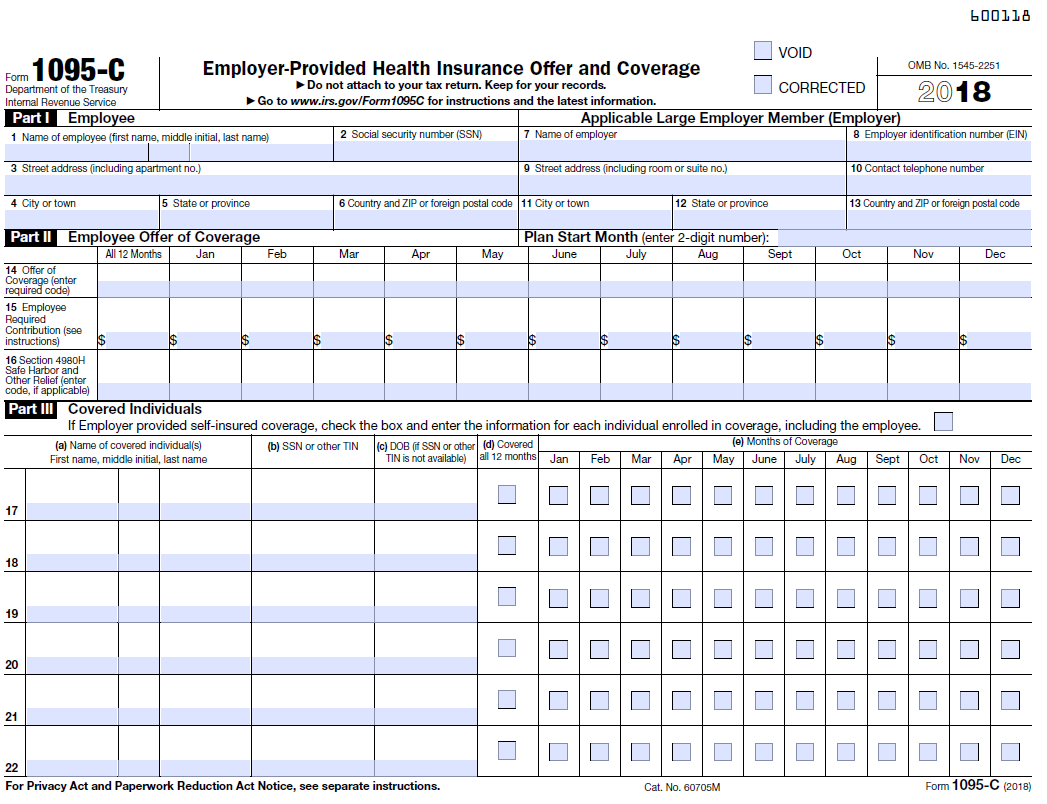

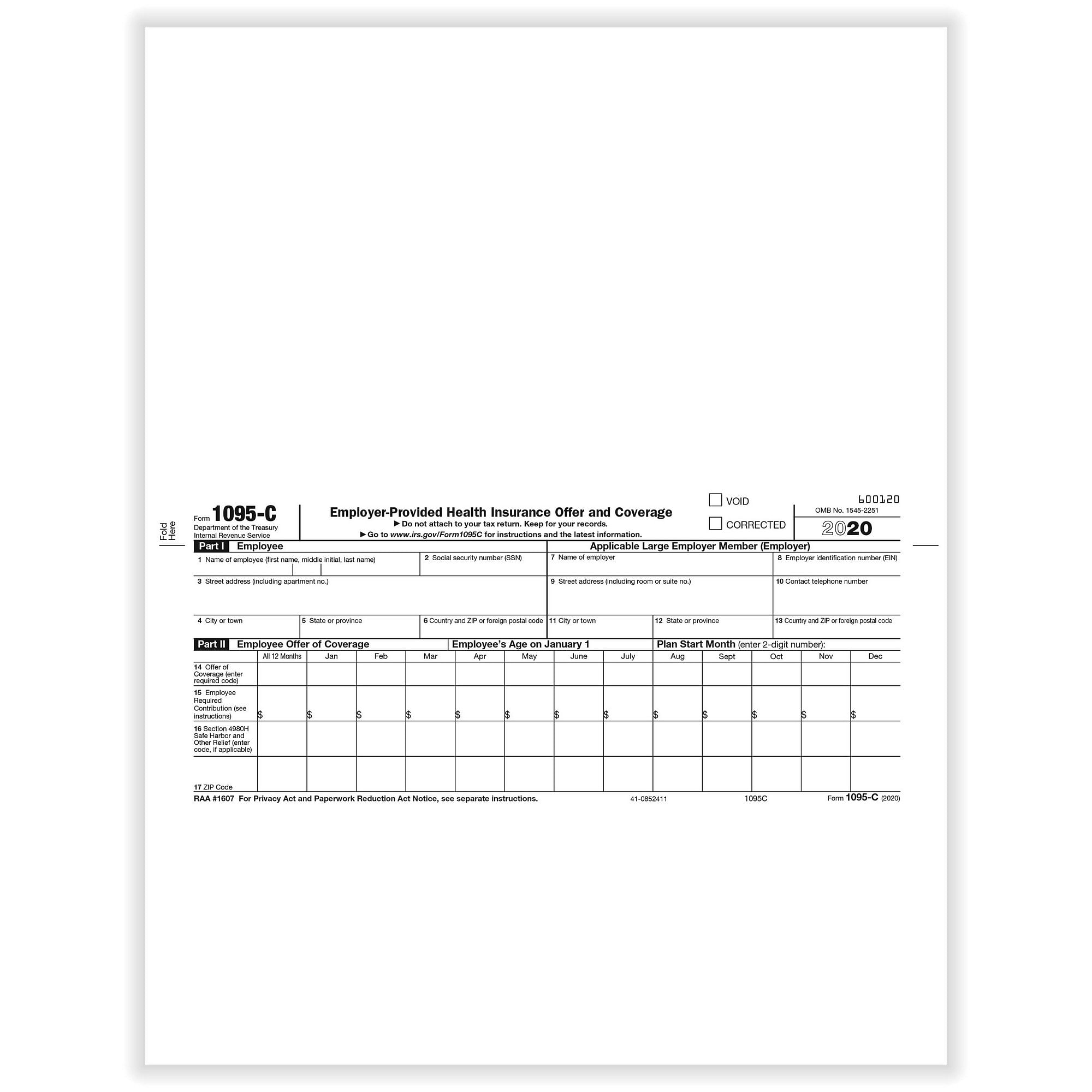

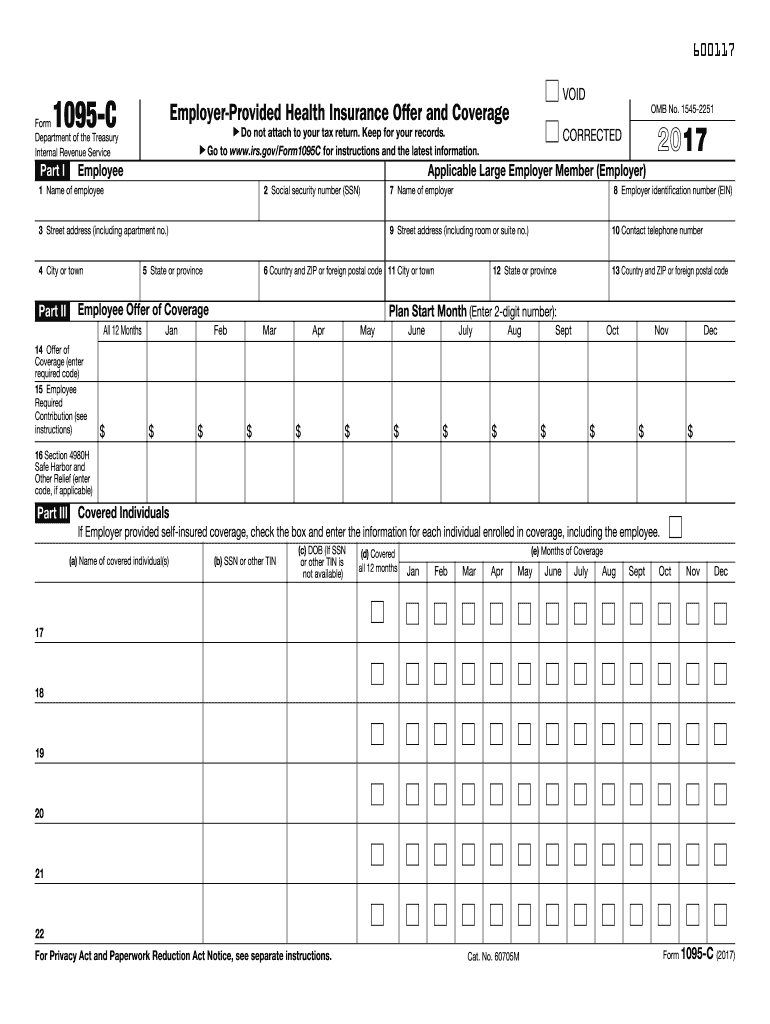

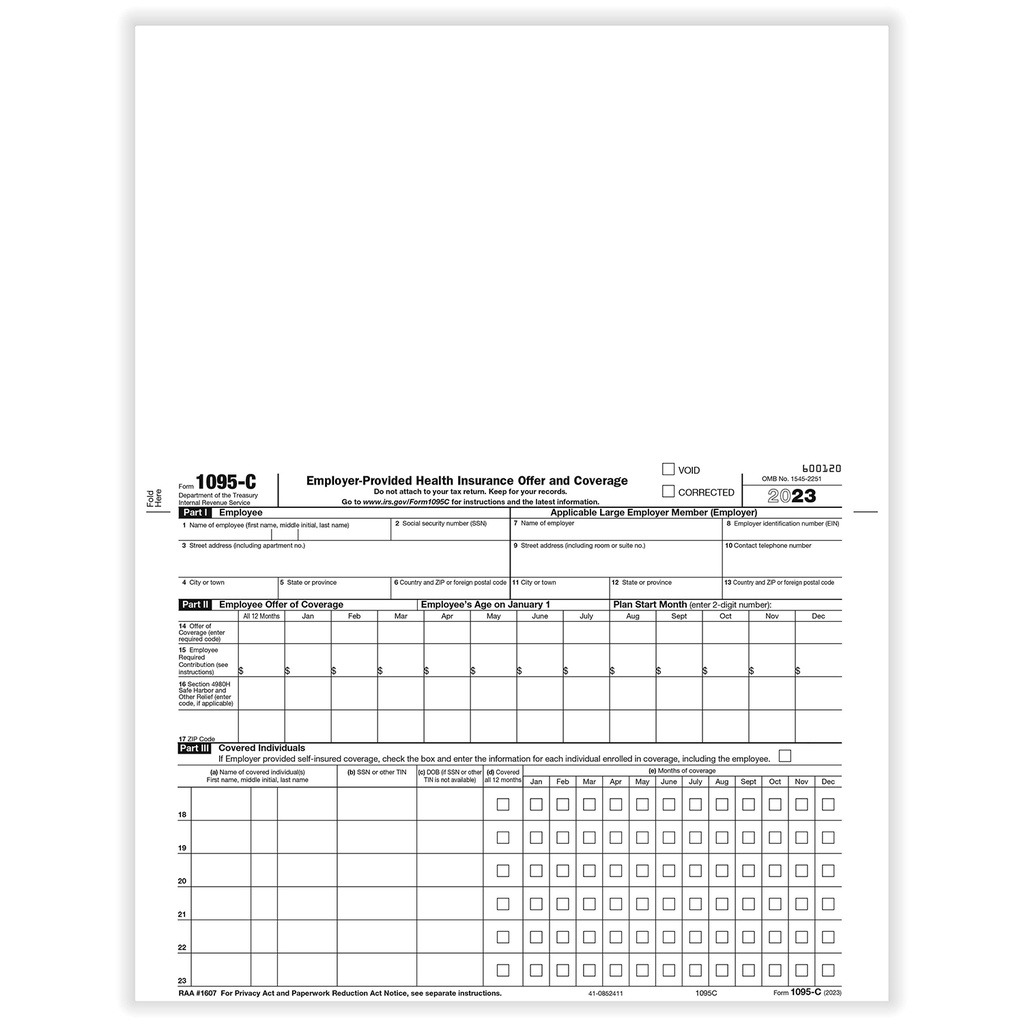

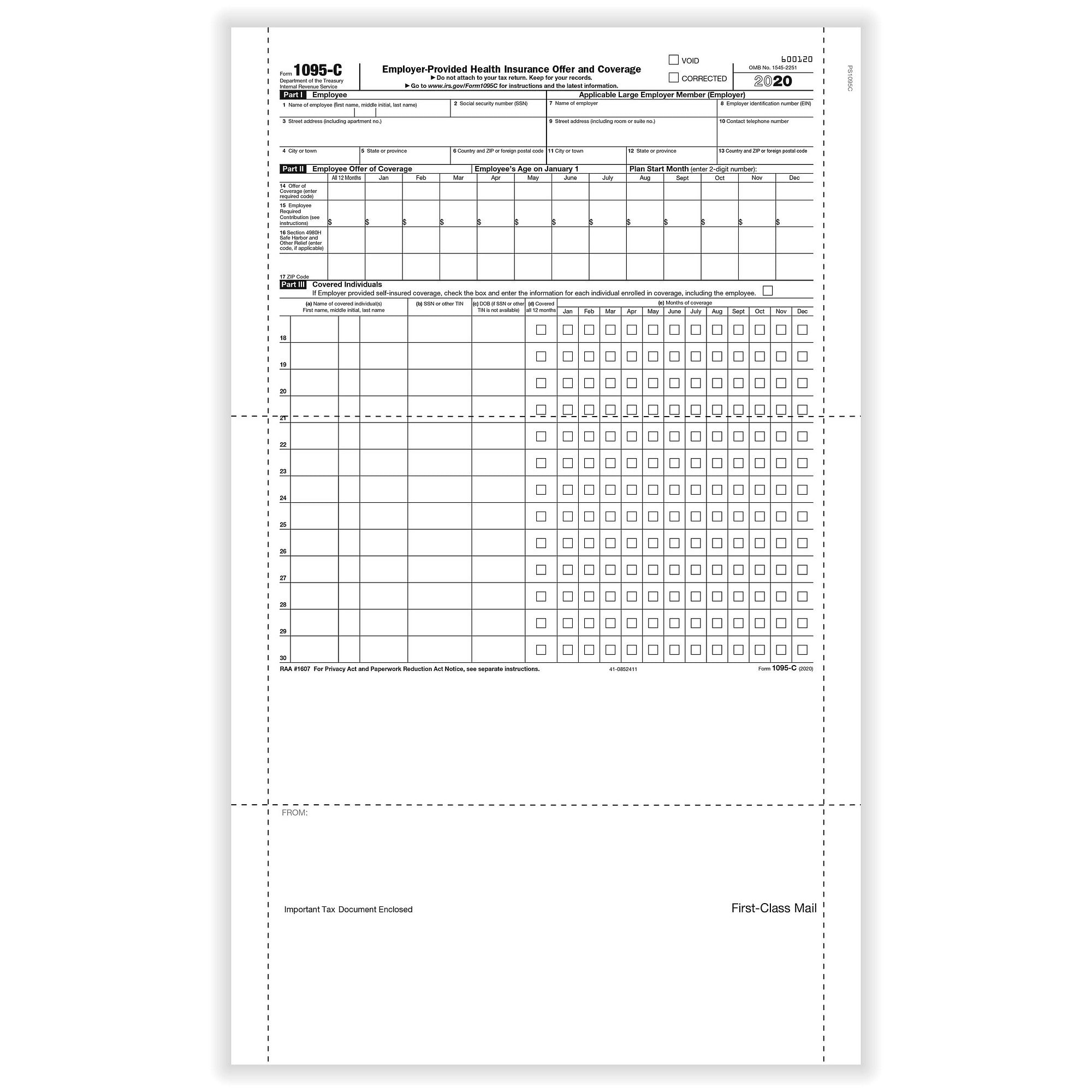

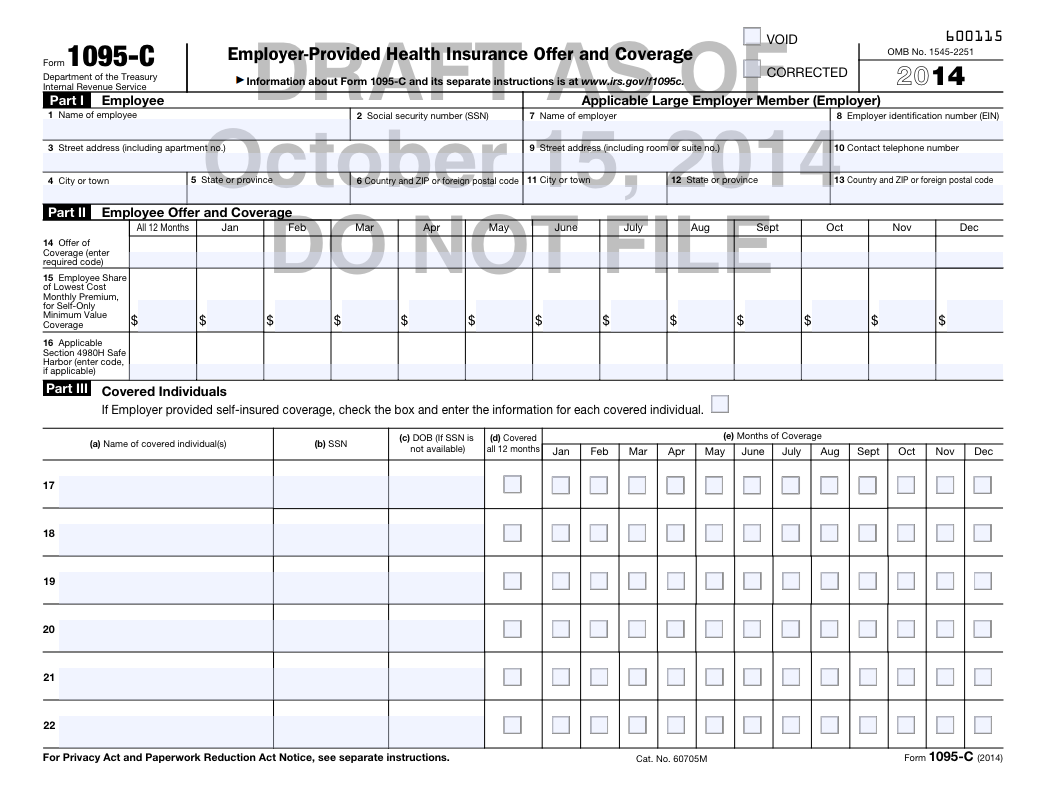

Generally 1095B forms are filed by insurers for employers who use the SHOP, small selffunded groups, and individuals who get covered outside of the health insurance Marketplace 1095C forms are filed by large employers If they are selffunded, they just fill out all sections of 1095CForm 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverageForm 1095C is for reporting employerprovided health insurance offer and coverage This form provides information employees will need to complete their individual tax returns Employees will show whether they or their dependents had offers for minimum essential coverage They will also show whether they received this coverage

Www Cps Edu Globalassets Cps Pages Staff Former Employees Payroll Form1095 C Faq Pdf

1095 c form meaning

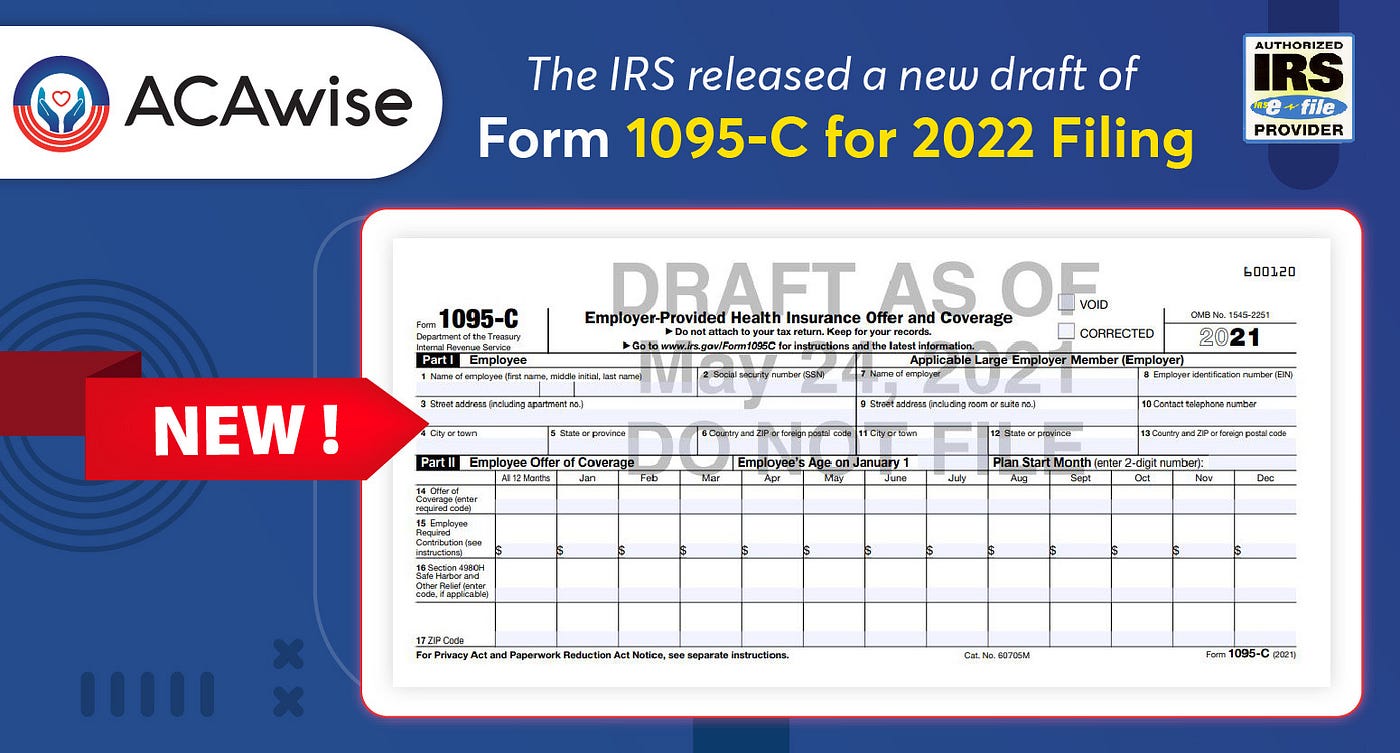

1095 c form meaning-The ACA Form 1095C, EmployerProvided Health Insurance Offer and Coverage is used by applicable large employers (Employers with 50 employees) to report their employees' health coverage information withEmployees must submit their consent to electronically receive Form 1095C in PeopleSoft by Tuesday, Employees who do not consent to receive an electronic 1095C will have a paper copy mailed to the address listed in PeopleSoft Instructions for consenting to electronically receive Form 1095C can be found here

Office Depot

The Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRSApplicable Large Employers (ALEs) now have until , to provide Forms 1095C to individuals If you work for an organization that employs more than 50 employees, you will receive a Form 1095C from your employer and may need to submit information from it as a part of your personal tax filing What is Form 1095C? A 1095C is also required for any employee enrolled in a selfinsured plan throughout the reporting year For more information see, IRSgov Instructions for Forms 1094C and 1095C Avionté will produce a 1095C for any employee who falls under the below criteria per the data in the Avionté system

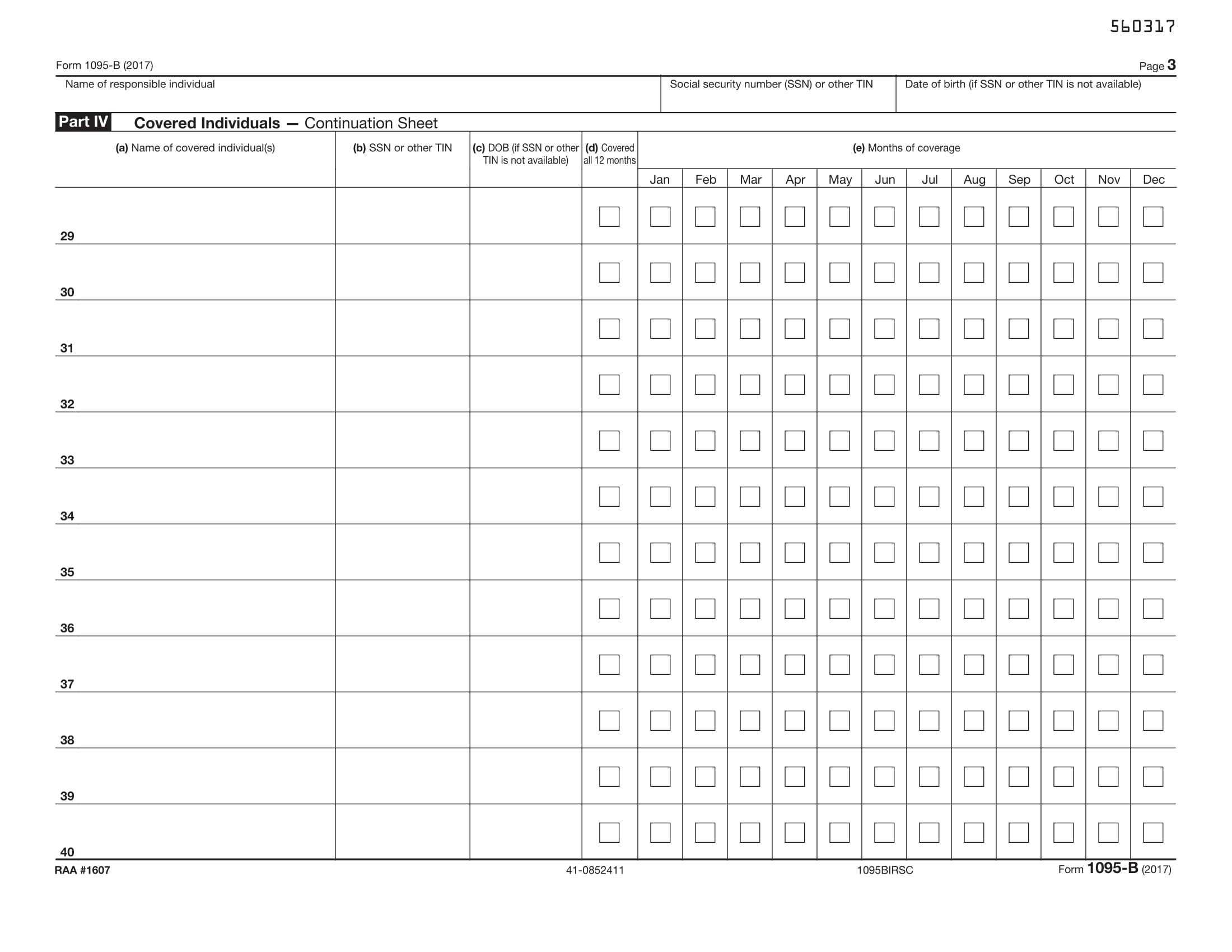

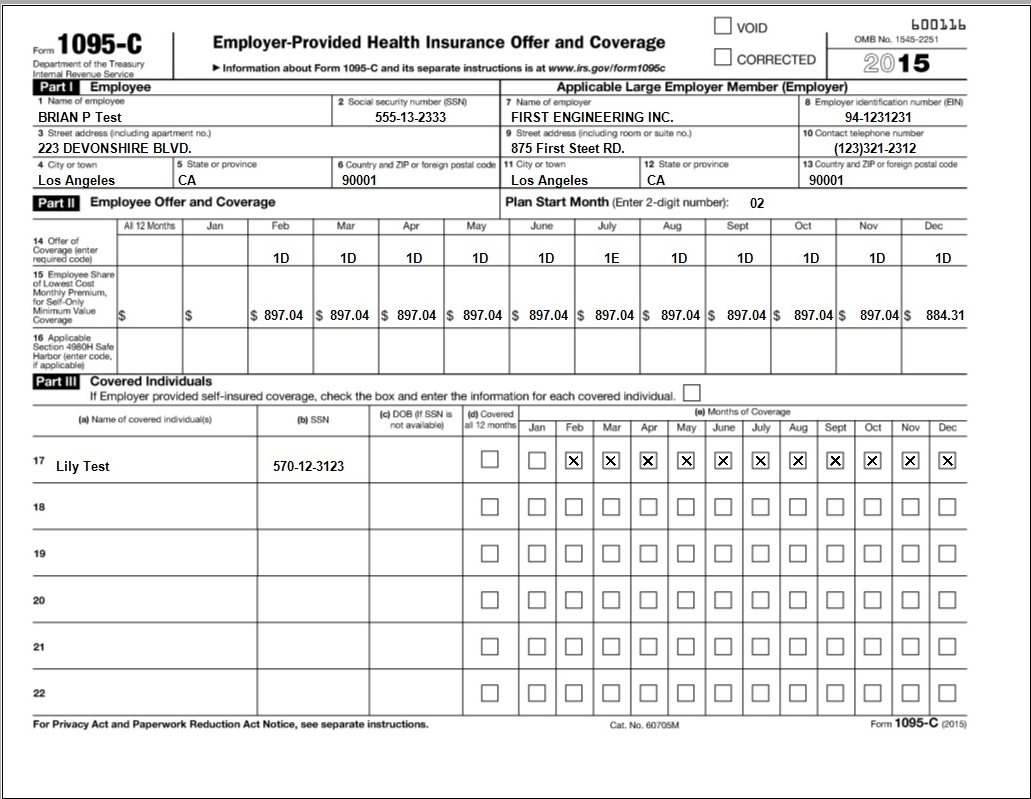

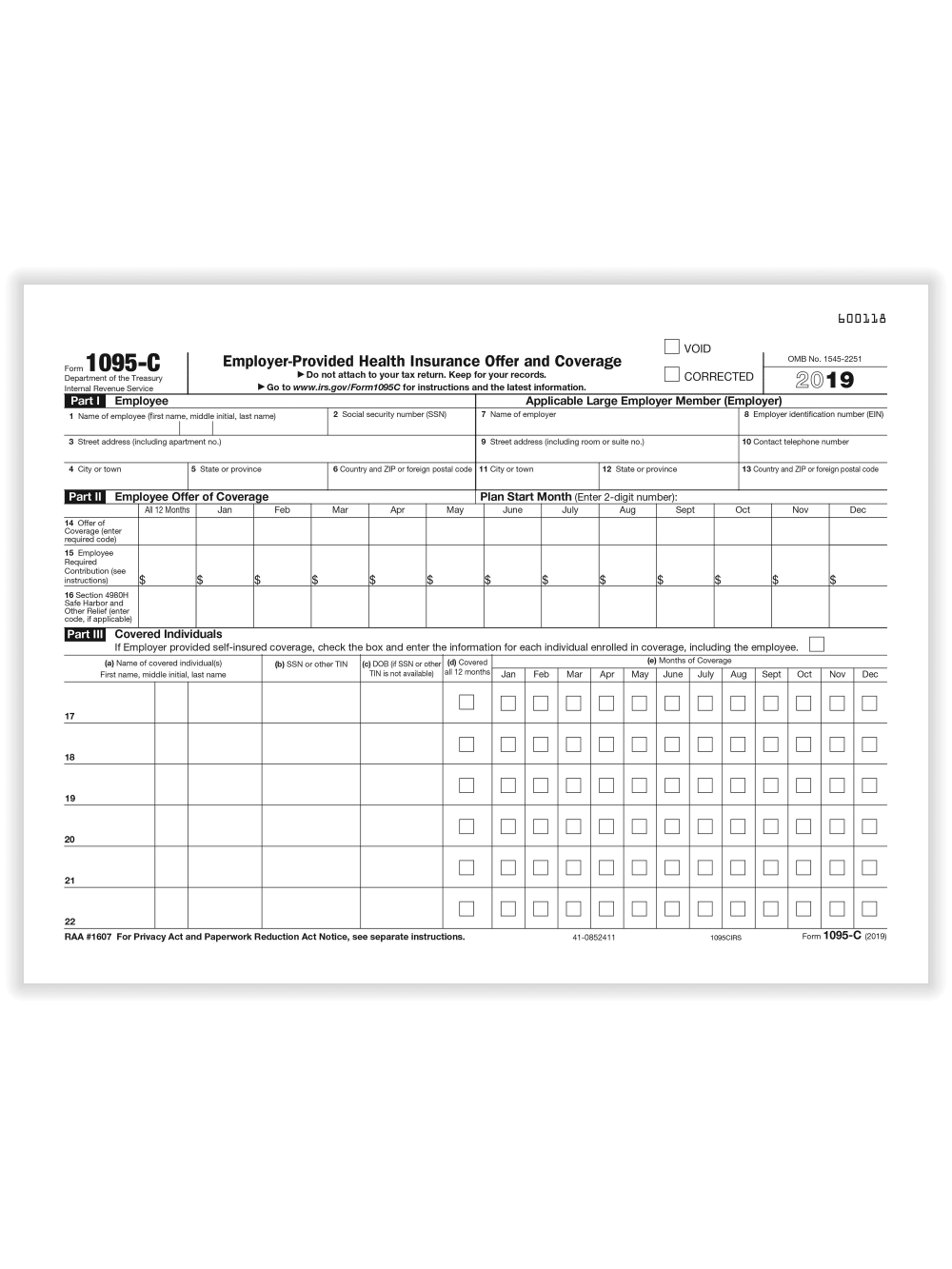

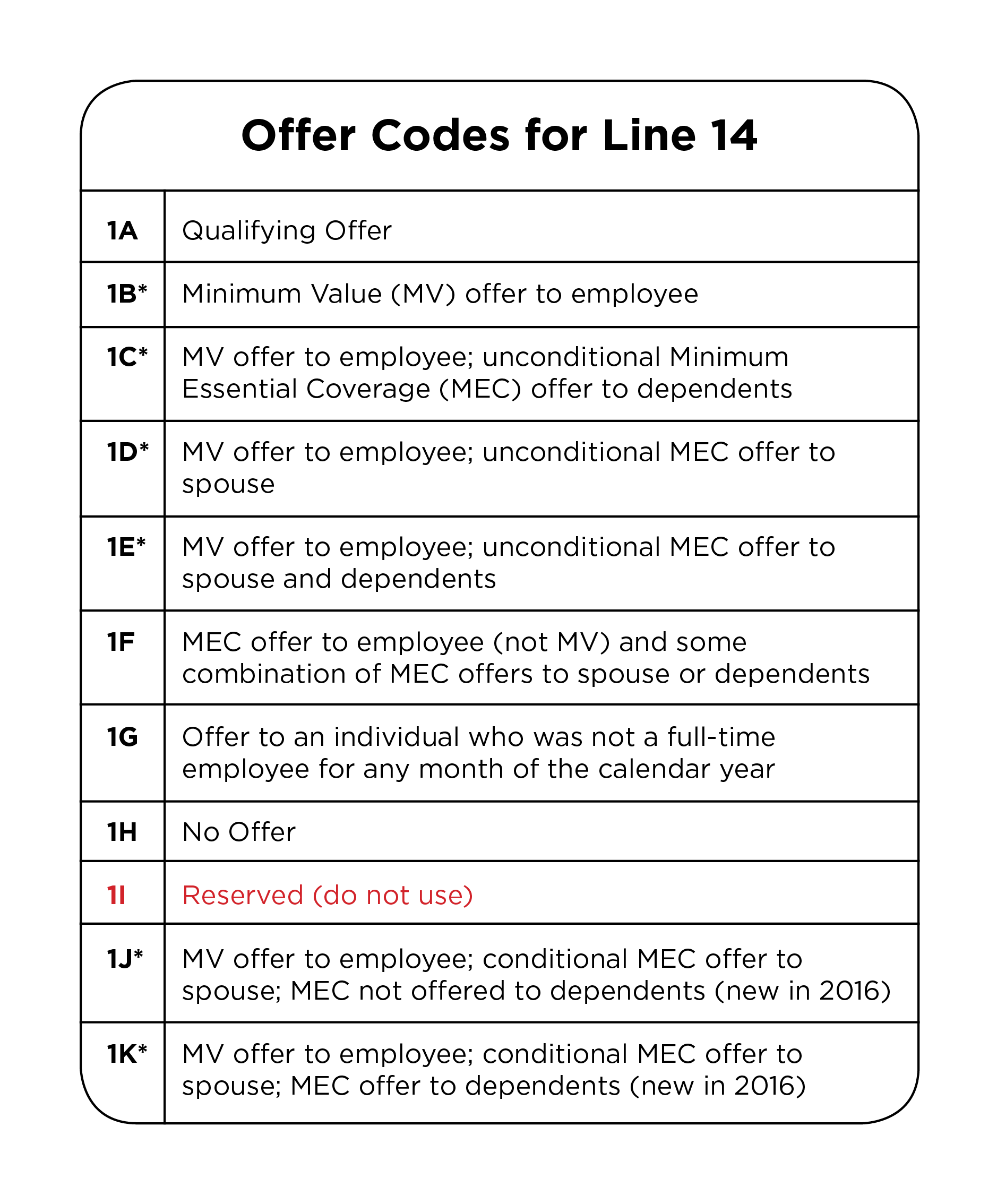

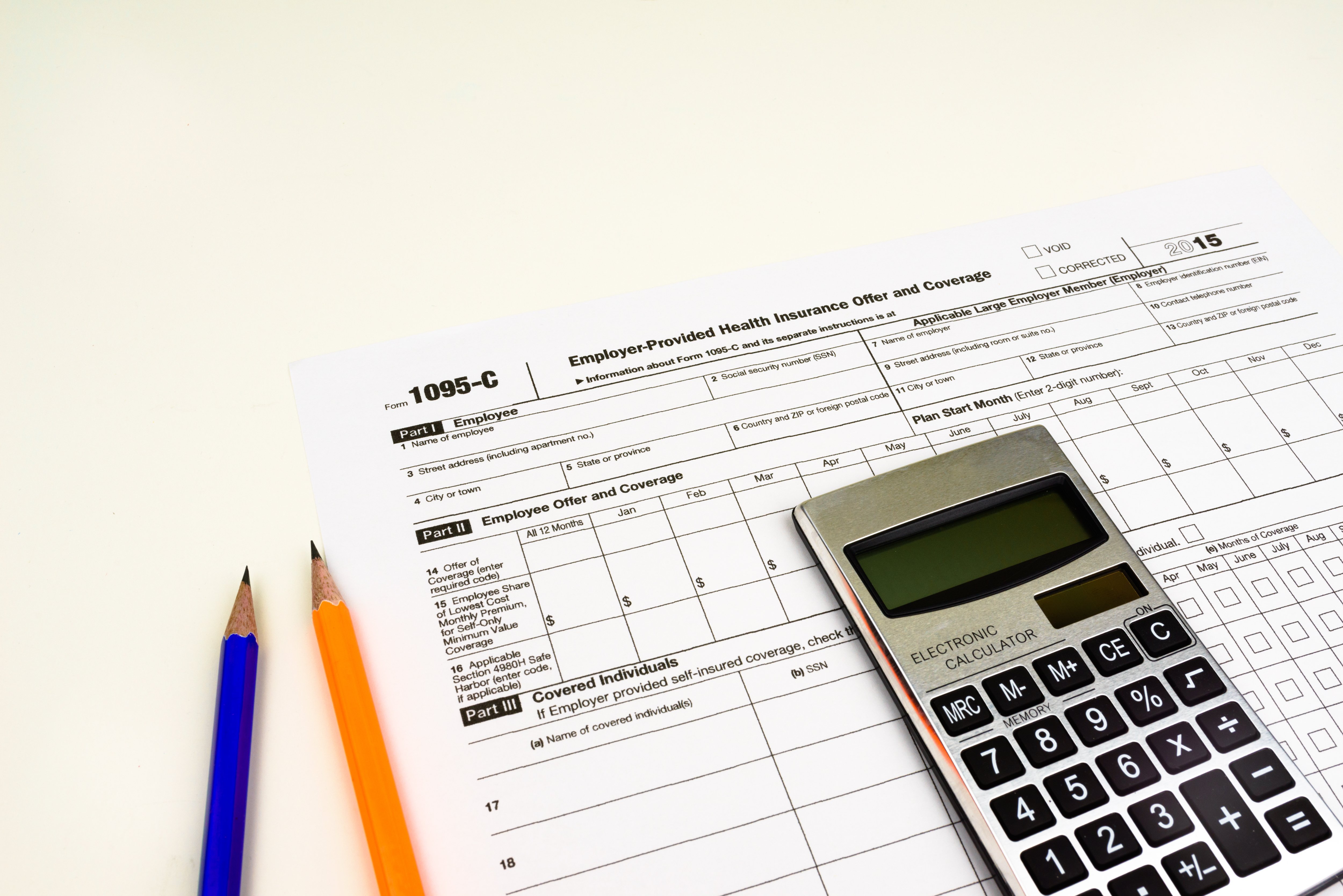

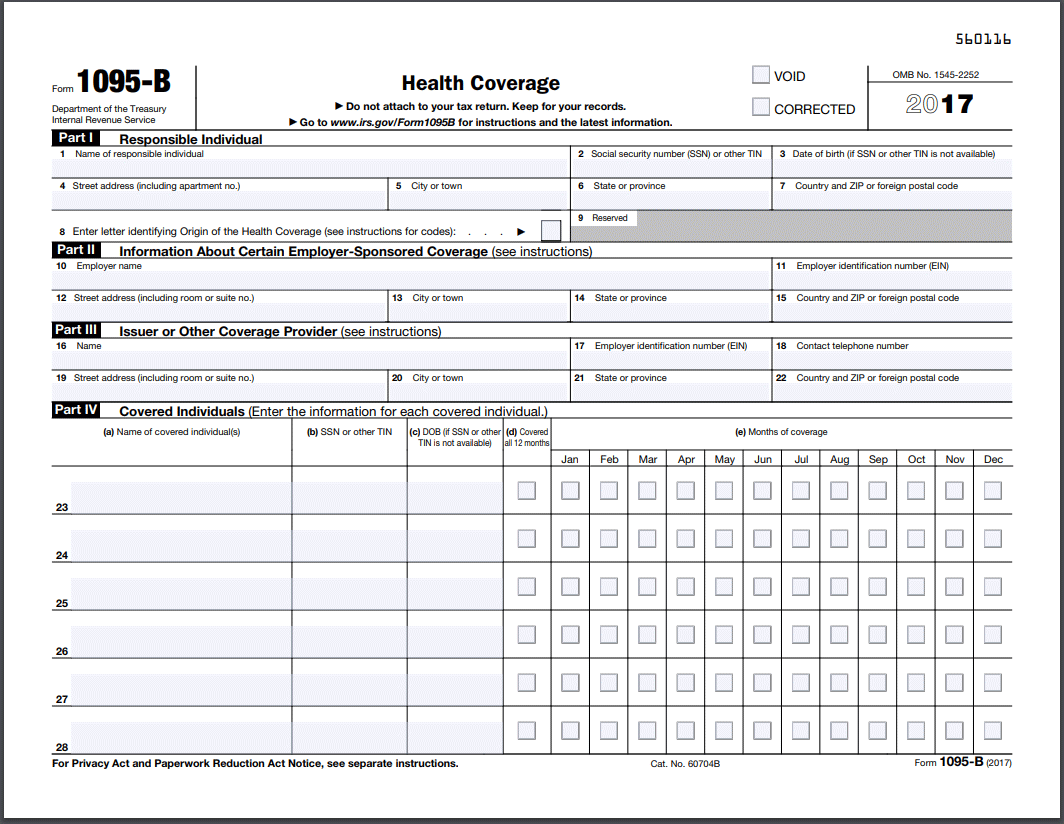

The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService Form 1095C contains a series of codes that indicate employee health insurance coverage For traditional health coverage, applicable codes include 1A through 1H If using a benefits administration software that automates the Form 1095C process, the software should populate the codes for the months they were enrolled in coverageForm 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent out

Form 1095C should be mailed to members from employers Form 1095C may be used to support proof of coverage and/or the offering of employer sponsored insurance on your tax filing However, you may not need to wait to receive your 1095 form (s) to complete your taxes Please visit the IRS page on health care information forms for more information1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21 However, you don't have to wait until then to file your return as you might get your information in a different way from your employer The form is informational and is used to report whether they offered Form 1095C is a tax form that provides you with information about employerprovided health insurance

Irs Form 1095 C From Integrity Data S Aca Compliance Solution Erp Software Blog

1095c Employer Provided Health Ins Irs Landscape Item 1095ci

Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax creditThe information contained on Form 1095C is informational and allows the preparer to verify that the taxpayer and/or their dependents have minimum essential health care coverage Although the Shared Responsibility Payment (or penalty) has been eliminated by the Tax Cuts and Jobs Act starting with the tax year 19 , employees will continue toForm 1095C is a required tax document under the Affordable Care Act (ACA) It contains detailed information about the medical coverage offered to you and your dependents by Miami University You will need the information from Form 1095C as part of your federal tax return

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

Aca 1095 C Basic Concepts

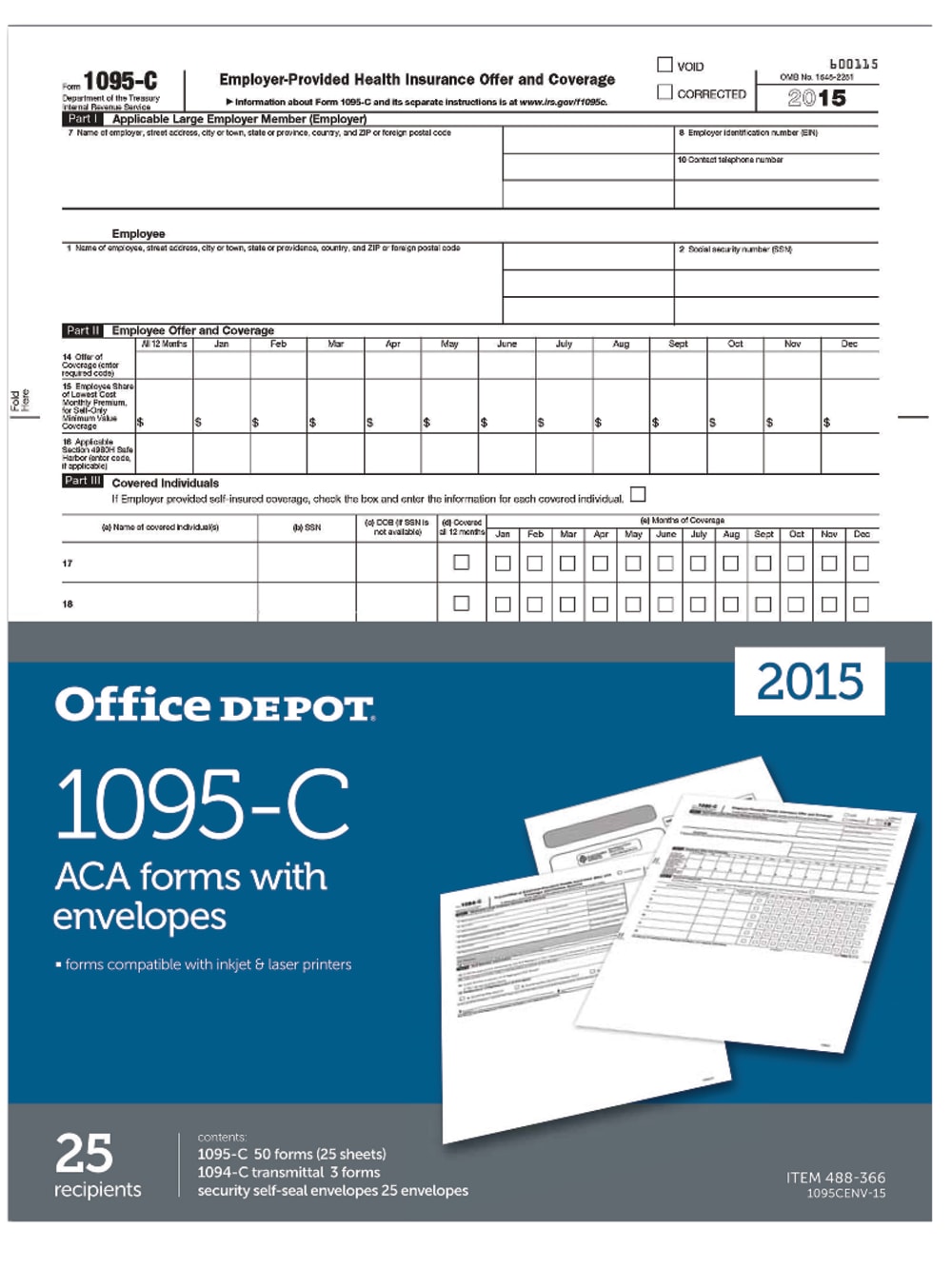

Filing Requirements for ACA Form 1095C The IRS has granted employers an extension for mailing ACA forms, thus providing a little breathing room for those involved in preparing the forms 1/25/19 Taxpayers may claim additional Affordable Care Act hardship exemptions without certification In recent guidance, the IRS identified exemptions from When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 141095C Form Information This new 1095C Form, related to the Affordable Care Act (ACA), is a certificate of EmployerProvided Health Insurance Offer and Coverage Beginning with tax year 15, this form is required by all large employers to report offers of health coverage and enrollment in health coverage

Irs Extends 1095 C Reporting Deadline And Good Faith Transition Relief

Www Umassmed Edu Globalassets Human Resources Documents Benefits Final 1095 C Faq 12 16 15 Pdf

The IRS Form 1095C is a form that reports to the IRS if you had the minimum essential coverage required under the ACA and also which months of the year you had the qualified coverage Why is it so important to prove I had minimum essential coverage? What is the purpose of ACA Form 1095C?A Form 1095C will be provided to all employees who were eligible to participate in state health insurance benefits at any point during , including eligible employees who declined to participate in the medical coverage Employees may choose to receive their form online or have it mailed to their home address on record with the University

Office Depot

1095 C Form 21 Finance Zrivo

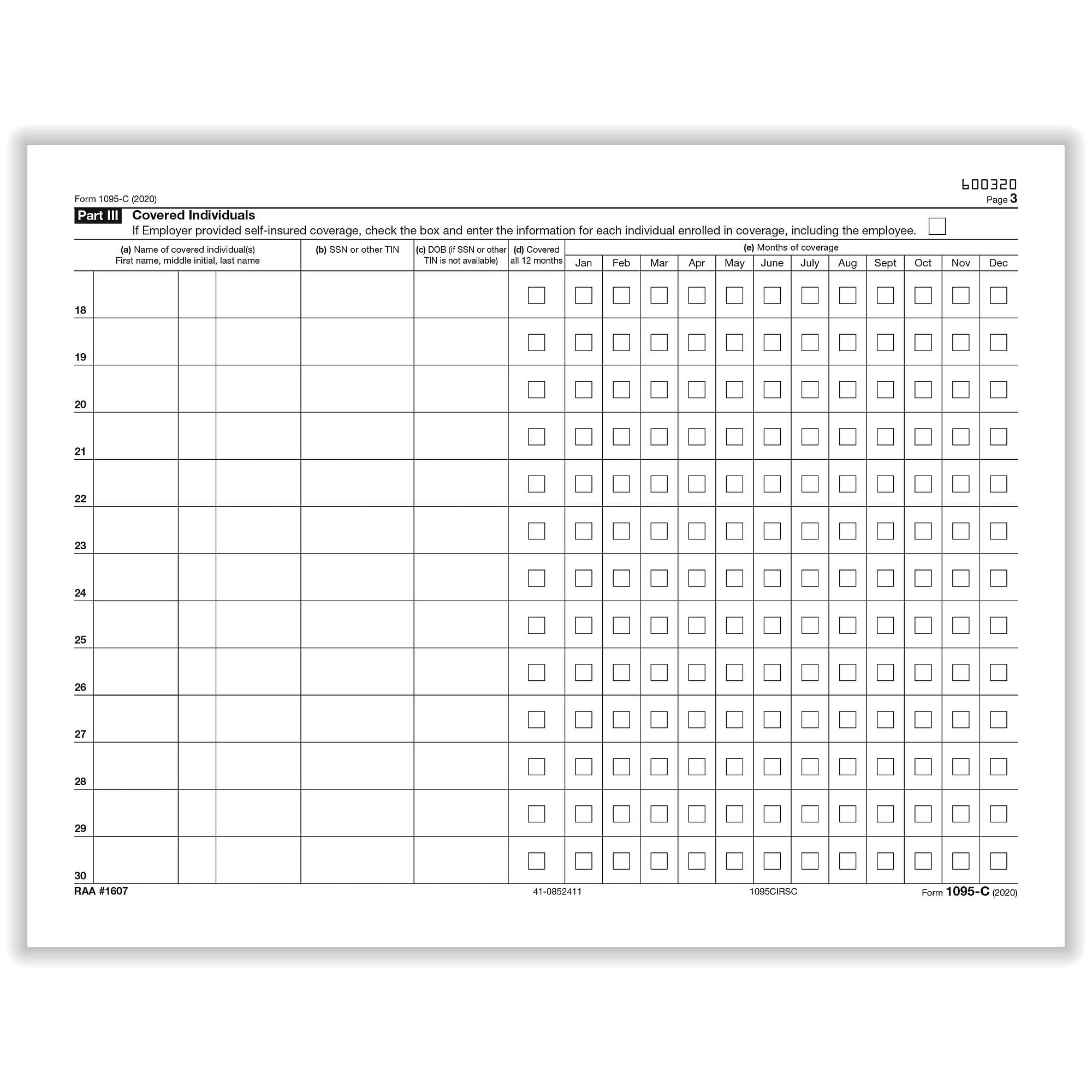

The IRS released for comments a draft of Form 1095C Employers will use the final version early next year to report on health coverage in The revisions add a second page to the form and may IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax seasonWhy choose ACA Compliance Reporting Form 1095C The new Form 1095C requires a large amount of information that employers must track throughout the calendar year Forms must be sent to employees annually by January 31 Companies with more than 250 employees are required to electronically file copies with the IRS and submit a transmittal Form

Form 1095 C Forms Human Resources Vanderbilt University

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingForm 1095C EmployerProvided Health Insurance Offer and Coverage is an Internal Revenue Service (IRS) tax form reporting information about an employee's health coverage offered byIRS Form 1095C is filed with the IRS by the applicable large employer (ALE) who offers health coverage and enrollment in health coverage for their employees Employers with 50 or more full time employees are considered ALEs Employers use 1095C Form to report the information required under section 6056

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Form 1095 C Mymontebenefits Com

Forms 1095C to the Internal Revenue Service (IRS) and to the FTB Federal Form 1095C is used to report information about each employee to the IRS, the FTB, and the employee The same federal Forms 1094C and 1095C the employer transmits to the IRS can be provided to the FTB under Revenue and Tax Code (R&TC) SectionThe 1095C Form is to report information to the IRS and to employees who have minimum essential coverage under the employer plan and have met the individual shared responsibility requirement for the months that they are covered under the plan You do not need to have a copy of your 1095C in order to file your taxesThe 1095C Form is to report information to the IRS and to employees who have minimum essential coverage under the employer plan and have met the individual shared responsibility requirement for the months that they are covered under the plan You do not need to have a copy of your 1095C in order to file your taxes

Das Iowa Gov Sites Default Files Aca Matrix Pdf

1

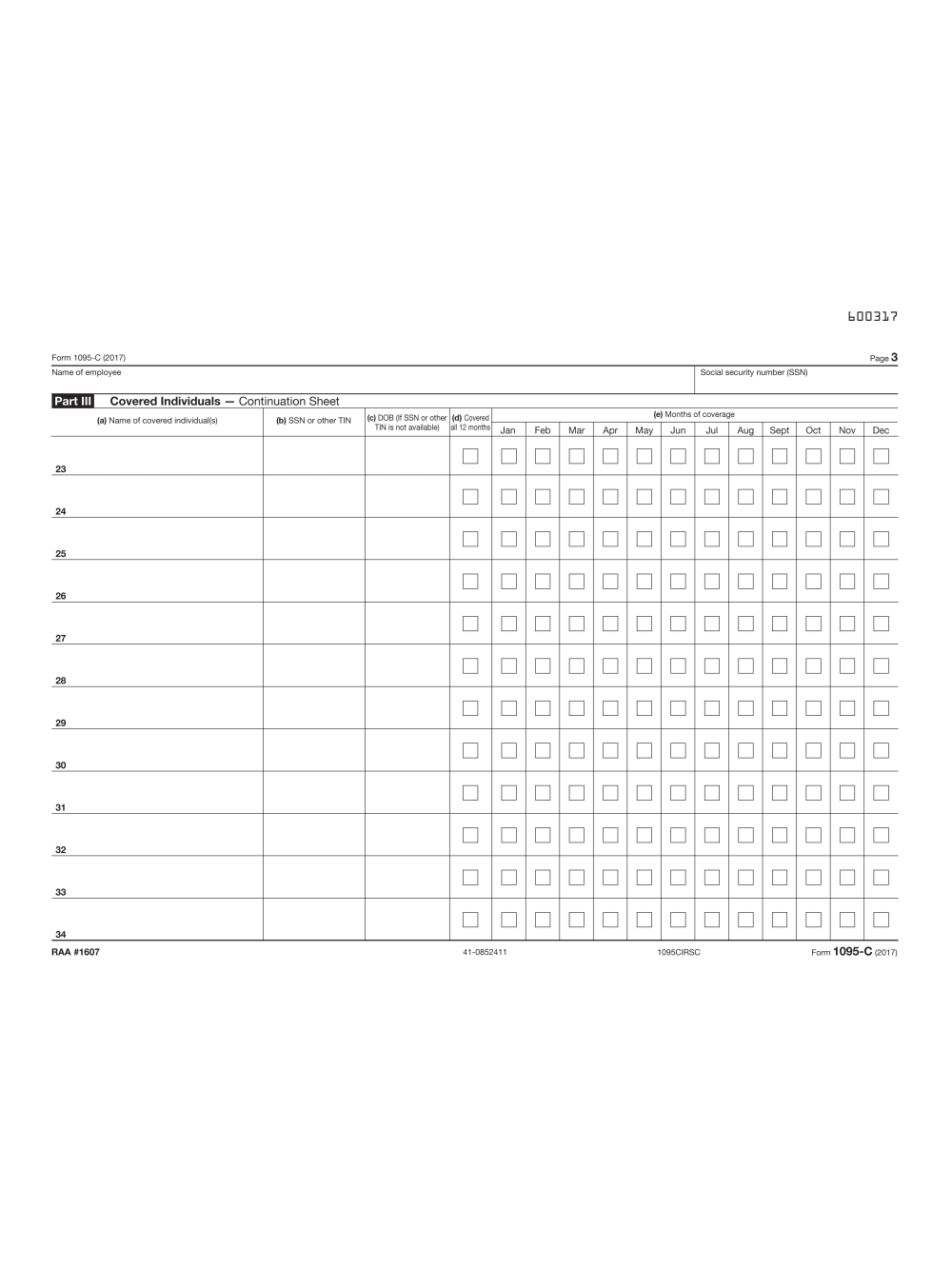

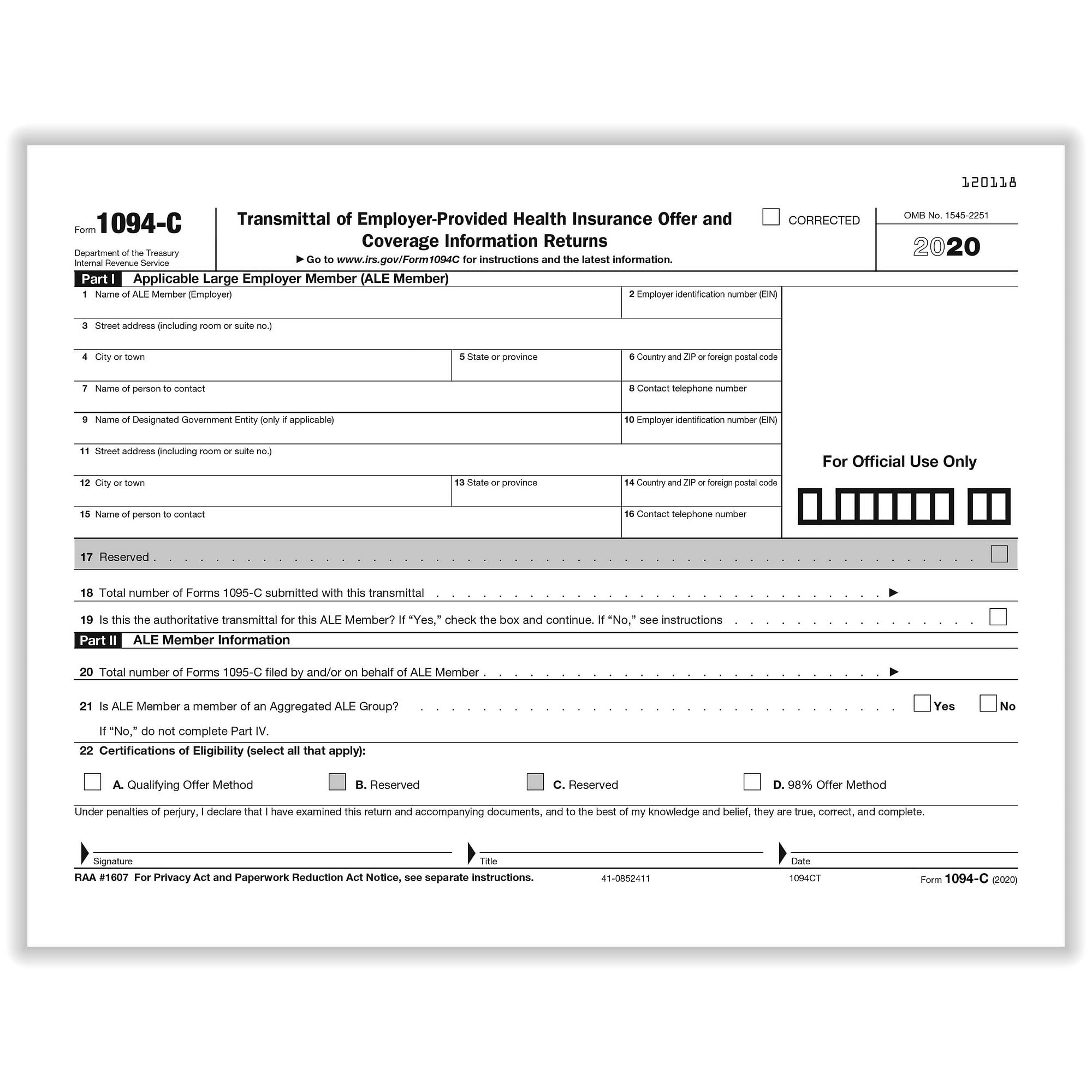

If you worked at more than one agency, municipality or company, you may receive a Form 1095C from each employer For example, if you changed jobs during the year and were enrolled in coverage with both employers, you should receive a 1095C from each employer Please note If you work for more than one job at the Commonwealth of MA (including Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on paperEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

Aca Code Cheatsheet

Irs Form 1095 C Employer Provided Health Insurance Offer And Coverage Tax Blank Lies On Empty Calendar Page Stock Photo Image By C Mehaniq

About Form 1095C In late February 21, the Health Care Authority, on behalf of your employer or former employer, will mail Forms 1095C and an explanatory insert to Employee, retiree, and continuation coverage subscribers of state agencies, commodity commissions, or higher education institutions enrolled in Uniform Medical Plan for at least one month in 19Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee IRS Form 1095C is a statement provided by an Applicable Large Employer (ALE) to each of its employees who were eligible for coverage in the previous year The form helps the IRS enforce the ACA employer mandate by monitoring the type and cost of coverage offered to employees, and the number of employees who were offered this coverage Form 1095C

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Irs Form 1095 C Image Photo Free Trial Bigstock

The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollmentForm 1095 is a collection of Internal Revenue Service (IRS) tax forms in the United States which are used to determine whether an individual is required to pay the individual shared responsibility provision Individuals can also use the health insurance information contained in the form/forms to help them fill out their tax returns System System Impact Employee Personal Page (EPP) New option, 1095C, added under Personal Info to print IRS Form 1095C New Option, Change Paper W2 & 1095C, added under Preferences to elect a no mailing option and allow employees to have their IRS Form 1095C available via EPP only Reporting Center (RPCT) New report, 1095C Statement, added to the

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Office Depot

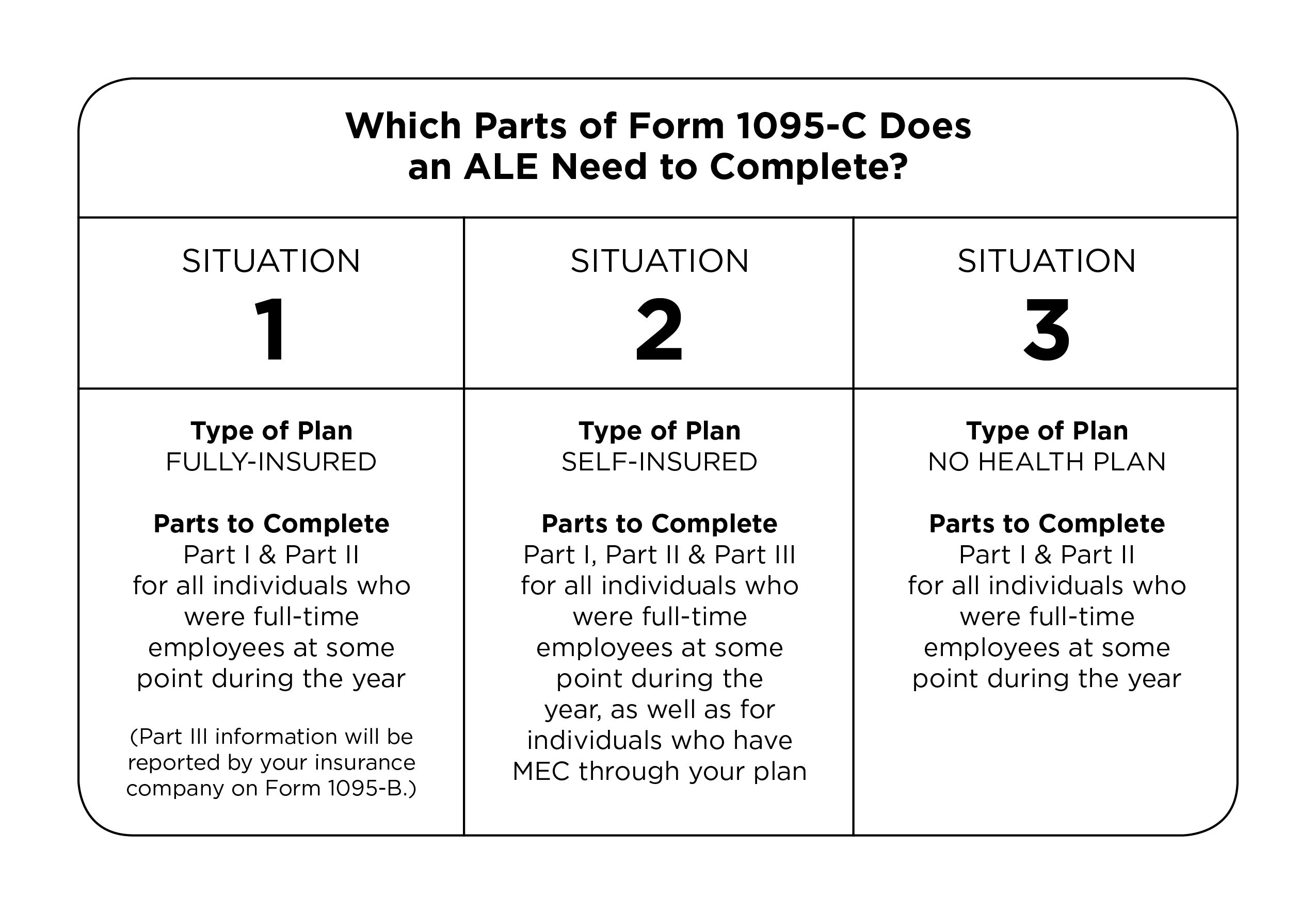

1095C forms are filed by large employers If they are selffunded, they just fill out all sections of 1095C If they are fully insured, they get a 1095B from the insurer and fill out Sections I and II of 1095C Does not need to be entered in TurbotaxThe penalty for failure to file a Form 1095C is generally $260 per employee The total form penalty for a calendar year generally cannot exceed $3,178,500 If you are not an ADP client, call to learn more about how we can help Or visit the IRS website for more information on ACA tax provisions for large employers

1095 C Employer Provided Health Insurance Employer Employee Copy For 21 5096 Tf5096

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

Www Cps Edu Globalassets Cps Pages Staff Former Employees Payroll Form1095 C Faq Pdf

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Stock Photo Picture And Royalty Free Image Image

Qritgkvszizhbm

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Page With Pen And Dollar Bills Tax Period Concept Copy Space For Text Stock Photo Alamy

Obamacare Tax Forms 1095 B And 1095 C 101

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

W 2 Laser Federal Irs Copy A

Your Tax Forms W 2 And 1095 C One Spirit Blog

2

Line By Line Instructions To Complete Form 1095 C Blog Acawise Aca Reporting Solution

1095 C 18 Public Documents 1099 Pro Wiki

Sample 1095 C Forms Aca Track Support

1095 C Employer Provided Health Insurance Offer And Coverage Form 250 Sheets Pack

Aca Forms

1

Affordable Care Act 101 What Is A 1095 C For 18 Reporting Youtube

Your 1095 C Obligations Explained

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Aca Compliance And Irs Form 1095 C Open Forum

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

22 1095 C Stock Photos Free Royalty Free 1095 C Images Depositphotos

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Control Tables And Sample Forms

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Page Stock Image Image Of Budget Currency

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

Irs Extends Deadline For Furnishing Form 1095 C Woodruff Sawyer

B95cfprec05 Form 1095 C Full Page Recipient Greatland Com

Tax Time Approaches Do You Know Where Your Forms Are Montgomery County Public Schools

Understanding Your 1095 C Documents Aca Track Support

Understanding Form 1095 C And What To Do About Errors The Aca Times

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

Affordable Care Act Aca Forms Mailed News Illinois State

Amazon Ehr Com Ess Client Documents Benefitsummaries 1095 C faqs updated 1 16 17 Pdf

The New 1095 C Codes For Explained

Affordable Care Act Form 1095 C Form And Software Hrdirect

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Aca Forms

1095 C Tax Forms Cwi

Employer Deadline To Furnish Forms 1095 B C To Plan Participants Extended To March 2 Sequoia

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

Office Depot

1095 C Faqs Mass Gov

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Form 1095 C H R Block

United Benefit Advisors Home News Article

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Hr Updates Theu

Form 1094 C And Form 1095 C B Benchmark Planning Group

Clearing Aca Confusion Which Employees Get Irs Form 1095 C

Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 500 Employees Amazon Sg Office Products

What Is A 1095 C Erp Software Blog

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/OBNPTJ3ZI5H45PGFNVWFGNBQGE.jpg)

Important Tax Document To Watch For

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Office Depot

Blog Form 1095 C

Your 1095 C Obligations Explained

Irs Extends Distribution Time Limit For Form 1095 Anderson Jones

1095 C Printing Microsoft Dynamics Gp Forum Community Forum

1

United Benefit Advisors Home News Article

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Q Tbn And9gcqx3fpg8io6zvvoaa1dsrwysrwjoqtyjh4wginzldvai4xjkc7a Usqp Cau

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Irs Form 1095 C Uva Hr

Instructions For Forms 1095 C Taxbandits Youtube

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Updated Affordable Care Act Form 1095 C Methodist Health System

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Www Irs Gov Pub Irs Schema 1095c Ty15 Cw Pdf

1095 C Employer Provided Health Insurance Offer And Coverage Form 14 Pressure Seal Ez Fold 500 Forms Carton

Payroll Aca Reporting Rda Systems

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Tax Time Approaches Do You Know Where Your W 2 Or 1095 C Forms Are Montgomery County Public Schools

Form 1095 C Basics Best Practices And Hr Compliance Bernieportal

Form 1095 C Community Tax

1095 C Irs Employer Provided Health Insurance Offer And Coverage Continuation Form Landscape Version 25 Sheets Pack

Oklahoma Gov Content Dam Ok En Omes Documents Faq Irs1095creporting Pdf